Asked by Jordan Hidayat on May 02, 2024

Verified

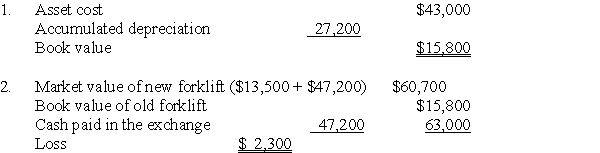

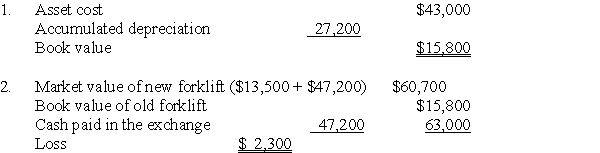

A company traded an old forklift for a new forklift,receiving a $13,500 trade-in allowance and paying the remaining $47,200 in cash.The old forklift had cost $43,000,a 5-year useful life and a $5,000 salvage value.Straight-line accumulated depreciation of $27,200 had been recorded as of the exchange date.

1.What was the book value of the old forklift on the date of the exchange?

2.What amount of gain or loss (indicate which)should be recognized in recording the exchange,assuming the transaction has commercial substance?

3.What amount should be recorded as the cost of the new forklift?

Trade-In Allowance

The amount credited to the buyer when they exchange an asset towards the purchase of a new asset.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in a linear fashion.

Commercial Substance

A characteristic of transactions that cause a significant change in the cash flows of a company.

- Organize entries in the general journal for cataloging transactions involving plant assets.

- Record transactions involving exchanges of similar and dissimilar assets with commercial substance.

Verified Answer

ZK

Zybrea KnightMay 07, 2024

Final Answer :  3.In this case,the new forklift should be recorded at its market value of $60,700.

3.In this case,the new forklift should be recorded at its market value of $60,700.

3.In this case,the new forklift should be recorded at its market value of $60,700.

3.In this case,the new forklift should be recorded at its market value of $60,700.

Learning Objectives

- Organize entries in the general journal for cataloging transactions involving plant assets.

- Record transactions involving exchanges of similar and dissimilar assets with commercial substance.