Asked by Charles Myles on Jun 14, 2024

Verified

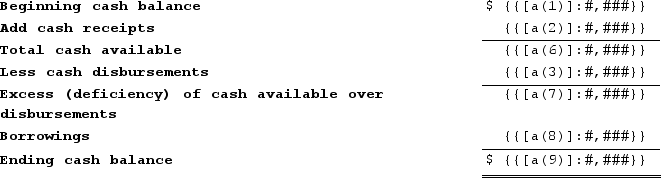

Zolezzi Incorporated is preparing its cash budget for March. The budgeted beginning cash balance is $30,000. Budgeted cash receipts total $101,000 and budgeted cash disbursements total $90,000. The desired ending cash balance is $85,000. The company can borrow up to $60,000 at any time from a local bank, with interest not due until the following month.Required:Prepare the company's cash budget for March in good form. Make sure to indicate what borrowing, if any, would be needed to attain the desired ending cash balance.

Cash Budget

A financial plan that estimates cash inflows and outflows over a specific period, used for managing liquidity and ensuring a company can meet its obligations.

Budgeted Cash Receipts

An estimation of the cash a company expects to receive within a certain period, based on projected sales or revenue.

Budgeted Cash Disbursements

An estimate of the total amount of cash an organization plans to pay out over a specified period, including operating expenses and purchase of assets.

- Determine cash revenues and expenditures to devise a plan for cash budgeting.

Verified Answer

Learning Objectives

- Determine cash revenues and expenditures to devise a plan for cash budgeting.

Related questions

Zolezzi Incorporated Is Preparing Its Cash Budget for March ...

Tsosie Corporation Makes One Product and It Provided the Following ...

Romeiro Corporation Is Preparing Its Cash Budget for September ...

Capes Corporation Is a Wholesaler of Industrial Goods ...

Capes Corporation Is a Wholesaler of Industrial Goods ...