Asked by Blake cannistraro on Jul 08, 2024

Verified

Capes Corporation is a wholesaler of industrial goods.Data regarding the store's operations follow:

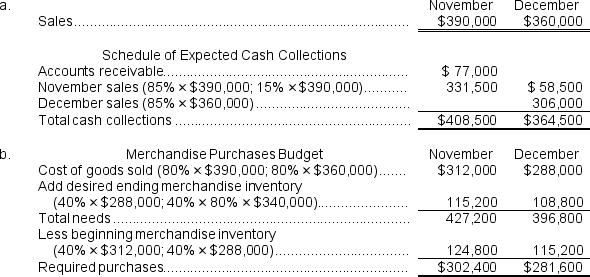

o Sales are budgeted at $390,000 for November, $360,000 for December, and $340,000 for January.

o Collections are expected to be 85% in the month of sale and 15% in the month following the sale.

o The cost of goods sold is 80% of sales.

o The company desires an ending merchandise inventory equal to 40% of the cost of goods sold in the following month.Payment for merchandise is made in the month following the purchase.

o The November beginning balance in the accounts receivable account is $77,000.

o The November beginning balance in the accounts payable account is $320,000.

Required:

a.Prepare a Schedule of Expected Cash Collections for November and December.

b.Prepare a Merchandise Purchases Budget for November and December.

Schedule of Expected Cash Collections

A detailed projection of the amounts and timing of cash inflows from receivables anticipated to be collected.

Merchandise Purchases Budget

A financial plan that outlines the expected purchases of merchandise inventory over a certain period, considering anticipated sales and desired inventory levels.

Accounts Receivable

Outstanding payments from clients to a business for goods delivered or services rendered, awaiting settlement.

- Construct and analyze budgets for cash collections, merchandise purchases, and cash disbursements.

Verified Answer

Learning Objectives

- Construct and analyze budgets for cash collections, merchandise purchases, and cash disbursements.

Related questions

Romeiro Corporation Is Preparing Its Cash Budget for September ...

Capes Corporation Is a Wholesaler of Industrial Goods ...

Tsosie Corporation Makes One Product and It Provided the Following ...

Zolezzi Incorporated Is Preparing Its Cash Budget for March ...

Zolezzi Incorporated Is Preparing Its Cash Budget for March ...