Asked by Cassi Crews on Jun 06, 2024

Verified

Tsosie Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations:> The budgeted selling price per unit is $103. Budgeted unit sales for April, May, June, and July are 9,300, 11,300, 9,800, and 12,800 units, respectively. All sales are on credit.> Regarding credit sales, 20% are collected in the month of the sale and 80% in the following month.> The ending finished goods inventory equals 10% of the following month's sales.> The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 2 pounds of raw materials. The raw materials cost $4.00 per pound.> Regarding raw materials purchases, 10% are paid for in the month of purchase and 90% in the following month.> The direct labor wage rate is $20.00 per hour. Each unit of finished goods requires 2.7 direct labor-hours.> The variable selling and administrative expense per unit sold is $3.70. The fixed selling and administrative expense per month is $80,000.Required:a. What are the budgeted sales for May?b. What are the expected cash collections for May?c. What is the budgeted accounts receivable balance at the end of May?d. According to the production budget, how many units should be produced in May?e. If 20,200 pounds of raw materials are needed for production in June, how many pounds of raw materials should be purchased in May?f. What is the estimated cost of raw materials purchases for May?g. If the cost of raw material purchases in April is $77,320, then in May what are the total estimated cash disbursements for raw materials purchases?h. What is the estimated accounts payable balance at the end of May?i. What is the estimated raw materials inventory balance at the end of May?j. What is the total estimated direct labor cost for May assuming the direct labor workforce is adjusted to match the hours required to produce the forecasted number of units produced?k. For simplicity, we will assume that there is no fixed manufacturing overhead and that the variable manufacturing overhead is $11.00 per direct labor-hour. What is the estimated unit product cost?l. What is the estimated finished goods inventory balance at the end of May?m. What is the estimated cost of goods sold and gross margin for May?n. What is the estimated total selling and administrative expense for May?o. What is the estimated net operating income for May?

Master Budget

An inclusive financial planning document that combines all of a company's individual budgets and plans for a specific period.

Credit Sales

Sales made by a business where payment is delayed as per agreed terms between the seller and the buyer.

Direct Labor

The wages and benefits paid to workers who are directly involved in the production of goods.

- Calculate and analyze budgeted sales based on given data.

- Estimate cash collections and disbursements to prepare a cash budget.

- Understand the steps and calculations involved in preparing a master budget, including sales, production, and cash budgets.

Verified Answer

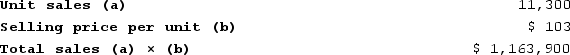

b. The expected cash collections for May are computed as follows:

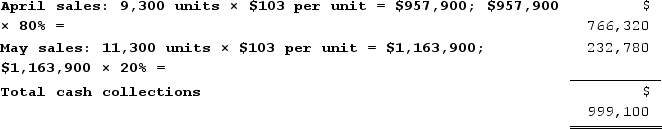

b. The expected cash collections for May are computed as follows: c. The budgeted accounts receivable balance at the end of May is:

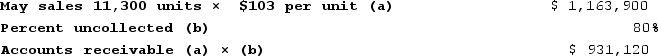

c. The budgeted accounts receivable balance at the end of May is: d. The budgeted required production for May is computed as follows:

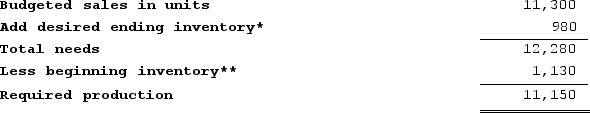

d. The budgeted required production for May is computed as follows: *June sales of 9,800 units × 10% = 980 units** May sales of 11,300 units × 10% = 1,130 unitse. The budgeted raw material purchases for May are computed as follows:

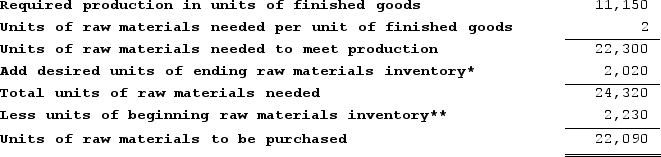

*June sales of 9,800 units × 10% = 980 units** May sales of 11,300 units × 10% = 1,130 unitse. The budgeted raw material purchases for May are computed as follows: * 20,200 pounds × 10% = 2,020 pounds.** 22,300 pounds × 10% = 2,230 pounds.f. The budgeted cost of raw material purchases for May is computed as follows:

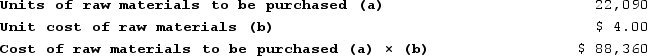

* 20,200 pounds × 10% = 2,020 pounds.** 22,300 pounds × 10% = 2,230 pounds.f. The budgeted cost of raw material purchases for May is computed as follows: g. The estimated cash disbursements for materials purchases in May is computed as follows:

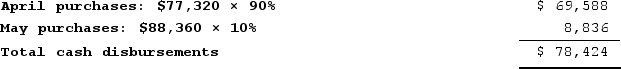

g. The estimated cash disbursements for materials purchases in May is computed as follows: h. The budgeted accounts payable balance at the end of May is:

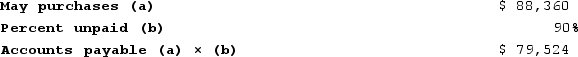

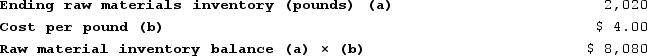

h. The budgeted accounts payable balance at the end of May is: i. The estimated raw materials inventory balance at the end of May is computed as follows:

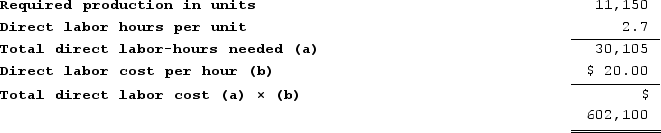

i. The estimated raw materials inventory balance at the end of May is computed as follows: j. The estimated direct labor cost for May is computed as follows:

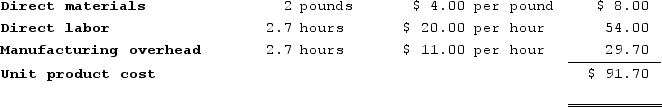

j. The estimated direct labor cost for May is computed as follows: k. The estimated unit product cost is computed as follows:

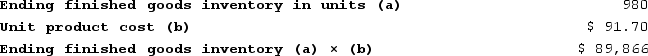

k. The estimated unit product cost is computed as follows: l. The estimated finished goods inventory balance at the end of May is computed as follows:

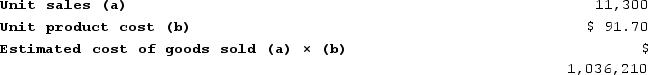

l. The estimated finished goods inventory balance at the end of May is computed as follows: m. The estimated cost of goods sold for May is computed as follows:

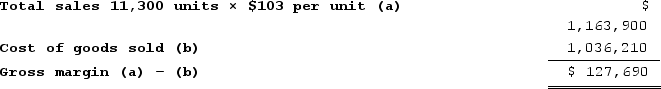

m. The estimated cost of goods sold for May is computed as follows: The estimated gross margin for May is computed as follows:

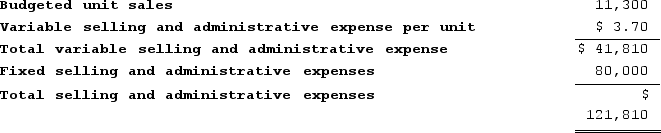

The estimated gross margin for May is computed as follows: n. The estimated selling and administrative expense for May is computed as follows:

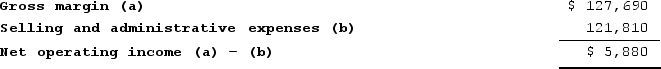

n. The estimated selling and administrative expense for May is computed as follows: o. The estimated net operating income for May is computed as follows:

o. The estimated net operating income for May is computed as follows:

Learning Objectives

- Calculate and analyze budgeted sales based on given data.

- Estimate cash collections and disbursements to prepare a cash budget.

- Understand the steps and calculations involved in preparing a master budget, including sales, production, and cash budgets.

Related questions

Whitmer Corporation Is Working on Its Direct Labor Budget for ...

The Production Department of Tarre Corporation Has Submitted the Following ...

Zolezzi Incorporated Is Preparing Its Cash Budget for March ...

Sthilaire Corporation Is Working on Its Direct Labor Budget for ...

Sthilaire Corporation Is Working on Its Direct Labor Budget for ...