Asked by Narghis Hashimi on May 17, 2024

Verified

Zang Co. manufactures its products in a continuous process involving two departments, Machining and Assembly. Prepare journal entries to record the following transactions related to production during June:

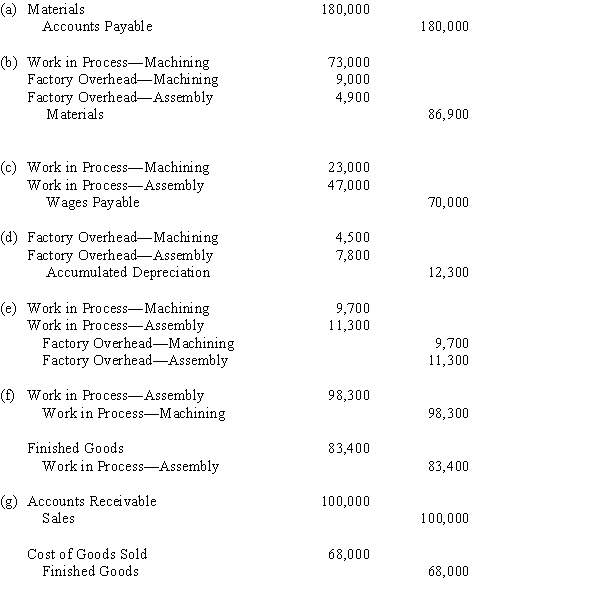

(a)Materials purchased on account, $180,000.

(b)Materials requisitioned by: Machining, $73,000 direct and $9,000 indirect materials; Assembly, $4,900 indirect materials.

(c)Direct labor used by Machining, $23,000; Assembly, $47,000.

(d)Depreciation expenses: Machining, $4,500; Assembly, $7,800.

(e)Factory overhead applied: Machining, $9,700; Assembly, $11,300.

(f)Machining Department transferred $98,300 to Assembly Department; Assembly Department transferred $83,400 to finished goods.

(g)Sold goods on account, $100,000; cost of goods sold, $68,000.

Factory Overhead Applied

The allocation of estimated factory overhead costs to individual units of production.

Depreciation Expenses

The systematic allocation of the depreciable amount of an asset over its useful life to account for wear and tear, obsolescence, or decay.

- Acquire knowledge of the basics in journalizing manufacturing cost transactions.

- Acquire knowledge on the journalization and treatment of direct and indirect materials along with labor expenses.

- Acquire knowledge on the method of distributing expenses between departments and into finished goods.

Verified Answer

DS

Learning Objectives

- Acquire knowledge of the basics in journalizing manufacturing cost transactions.

- Acquire knowledge on the journalization and treatment of direct and indirect materials along with labor expenses.

- Acquire knowledge on the method of distributing expenses between departments and into finished goods.

Related questions

Fast-Flow Paints Produces Mixer Base Paint Through a Two-Stage Process ...

The Estimated Total Factory Overhead Cost and Total Machine Hours ...

A Firm Produces Its Products by a Continuous Process Involving ...

The Cost of Materials Transferred into the Bottling Department of ...

The Brass Works Is in the Process of Determining Manufacturing ...