Asked by Christina Ercolani on May 16, 2024

Verified

A firm produces its products by a continuous process involving three production departments, 1 through 3. Prepare journal entries to record the following selected transactions related to production during August:

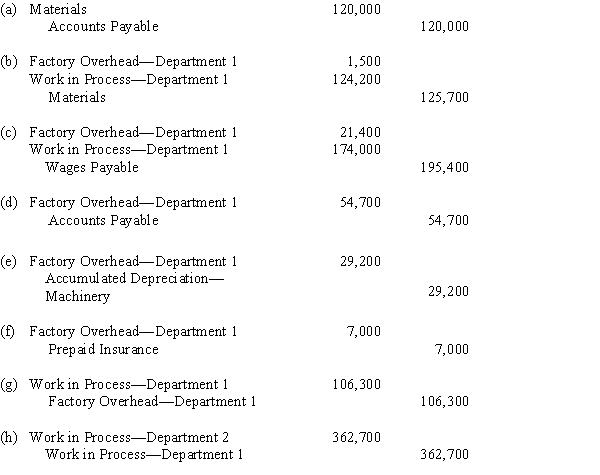

(a)Materials purchased on account, $120,000.

(b)Material requisitioned for use in Department 1, $125,700, of which $124,200 entered directly into the product.

(c)Labor cost incurred in Department 1, $195,400, of which $174,000 was used directly in the manufacture of the product.

(d)Factory overhead costs for Department 1 incurred on account, $54,700.

(e)Depreciation on machinery in Department 1, $29,200.

(f)Expiration of prepaid insurance chargeable to Department 1, $7,000.

(g)Factory overhead applied to production in Department 1, $106,300.

(h)Output of Department 1 transferred to Department 2, $362,700.

Factory Overhead Costs

Factory overhead costs encompass all indirect costs associated with manufacturing, excluding direct materials and direct labor.

Depreciation

The systematic allocation of the cost of a tangible asset over its useful life, representing the asset's wear and tear, deterioration, or obsolescence.

Prepaid Insurance

An asset account that represents the amount of insurance premiums that have been paid in advance and that has not yet expired as of the balance sheet date.

- Gain an understanding of the principles involved in documenting transactions pertaining to manufacturing costs.

- Gain insight into the processing and documentation of costs associated with direct and indirect materials and workforce.

- Acquire knowledge on how to calculate and apply manufacturing overhead costs.

Verified Answer

Learning Objectives

- Gain an understanding of the principles involved in documenting transactions pertaining to manufacturing costs.

- Gain insight into the processing and documentation of costs associated with direct and indirect materials and workforce.

- Acquire knowledge on how to calculate and apply manufacturing overhead costs.

Related questions

Zang Co Manufactures Its Products in a Continuous Process Involving ...

Eagle Co Manufactures Bentwood Chairs and Tables ...

Tough Hardware Purchases Raw Materials and Processes Those Purchases Through ...

On March 1, Upton Company's Packaging Department Had Work in ...

Fast-Flow Paints Produces Mixer Base Paint Through a Two-Stage Process ...