Asked by drishika gulati on May 20, 2024

Verified

The Brass Works is in the process of determining manufacturing overhead. Journalize events (a) through (d) to Factory Overhead, Administrative Expenses, or Selling Expenses, or allocate between the three as appropriate. All items were paid in cash at the time of acquisition. Next, calculate the overhead application rate and apply overhead to Work in Process.

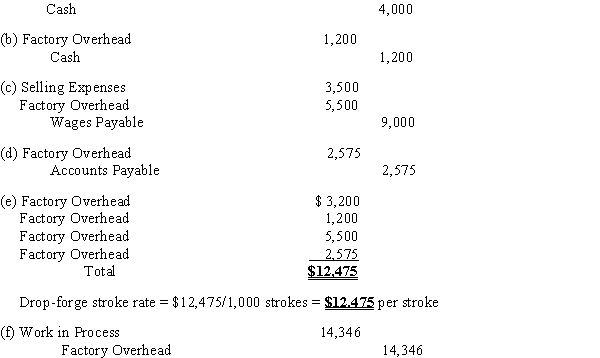

(a)Brass Works purchases an insurance policy for $4,000. It has been determined that 80% of the value of the policy protects production, and the balance protects the administrative offices. Brass Works charges insurance initially to expense.

(b)The electric bill shows an amount due of $1,200. This meter is utilized only by production, as the office spaces have their own meter.

(c)Payroll reports that the sales manager's salary for the period is $3,500 and that production supervisors' wages for the period are $5,500.

(d)The stockroom reports that $2,575 in materials were purchased for the Maintenance Department.

(e)If the driver for the application of overhead is drop-forge strokes and there are expected to be 1,000 strokes in this period, what is the rate per stroke? Do not round your answer.

(f)Assuming that there are 1,150 drop-forge strokes in this period, apply factory overhead to Work in Process. Round your answers to the nearest dollar.?Round overhead rate to three decimal places and total cost to the nearest dollar.

Manufacturing Overhead

Costs, other than direct materials and direct labor costs, that are incurred in the manufacturing process.

Factory Overhead

encompasses all indirect costs associated with manufacturing operations, including utilities, maintenance, and factory manager salaries.

Administrative Expenses

Expenses related to the general operation of a business, such as salaries of executive officers and costs of general services.

- Understand the principles of journalizing transactions related to manufacturing costs.

- Calculate and apply overhead application rates in manufacturing settings.

Verified Answer

($4,000 × 80%) 3,200Administrative Expenses

($4,000 × 20%) 800

Learning Objectives

- Understand the principles of journalizing transactions related to manufacturing costs.

- Calculate and apply overhead application rates in manufacturing settings.

Related questions

Tough Hardware Purchases Raw Materials and Processes Those Purchases Through ...

A Firm Produces Its Products by a Continuous Process Involving ...

The Estimated Total Factory Overhead Cost and Total Machine Hours ...

Zang Co Manufactures Its Products in a Continuous Process Involving ...

Fast-Flow Paints Produces Mixer Base Paint Through a Two-Stage Process ...