Asked by Brendan Lorenzana on May 18, 2024

Verified

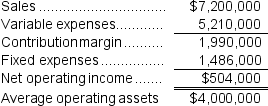

Wolley Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

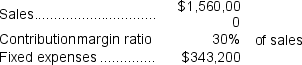

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1.What was last year's margin? (Round to the nearest 0.1%.)

2.What was last year's turnover? (Round to the nearest 0.01.)

3.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4.What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5.What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6.What is the ROI related to this year's investment opportunity? (Round to the nearest 0.1%.)

7.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall ROI will this year? (Round to the nearest 0.1%.)

10.If Westerville's chief executive officer earns a bonus only if the ROI for this year exceeds the ROI for last year, would the CEO pursue the investment opportunity? Would the owners of the company want the CEO to pursue the investment opportunity?

Turnover

The rate at which inventory or assets of a business are replaced or sales are made over a specific period.

Margin

Generally refers to the difference between the selling price of a good or service and its cost, expressed as a percentage of the selling price.

- Gauge the return on investment (ROI) and interpret its significance.

- Investigate investment avenues by scrutinizing their residual income and ROI.

Verified Answer

VE

Vanessa EscaleraMay 19, 2024

Final Answer :

1.Last year's Margin = Net operating income ÷ Sales = $504,000 ÷ $7,200,000 = 7.0%

2.Last year's Turnover = Sales ÷ Average operating assets = $7,200,000 ÷ $4,000,000 = 1.80

3.Last year's ROI = Net operating income ÷ Average operating assets = $504,000 ÷ $4,000,000 = 12.6%

or

ROI = Margin × Turnover = 7.0% × 1.80 = 12.6%

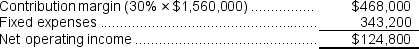

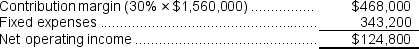

4.The margin for this year's investment opportunity is: Margin = Net operating income ÷ Sales = $124,800 ÷ $1,560,000 = 8.0%

Margin = Net operating income ÷ Sales = $124,800 ÷ $1,560,000 = 8.0%

5.The turnover for this year's investment opportunity is:

Turnover = Sales ÷ Average operating assets = $1,560,000 ÷ $1,200,000 = 1.30

6.The ROI for this year's investment opportunity is:

ROI = Net operating income ÷ Average operating assets = $124,800 ÷ $1,200,000 = 10.4%

or

ROI = Margin × Turnover = 8.0% × 1.30 = 10.4%

7.If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be:

Net operating income = $504,000 + $124,800 = $628,800

Sales = $7,200,000 + $1,560,000 = $8,760,000

Margin = Net operating income ÷ Sales = $628,800 ÷ $8,760,000 = 7.2%

8.If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

Sales = $7,200,000 + $1,560,000 = $8,760,000

Average operating assets = $4,000,000 + $1,200,000 = $5,200,000

Turnover = Sales ÷ Average operating assets = $8,760,000 ÷ $5,200,000 = 1.68

9.If the company pursues the investment opportunity and otherwise performs the same as last year, the ROI will be:

ROI = Net operating income ÷ Average operating assets = $628,800 ÷ $5,200,000 = 12.1%

or

ROI = Margin × Turnover = 7.2% × 1.68 = 12.1%

10.The CEO would not pursue the investment opportunity because it decreases the overall ROI.The owners of the company would not want the CEO to pursue the investment opportunity because its ROI is less than the company's minimum required rate of return.

2.Last year's Turnover = Sales ÷ Average operating assets = $7,200,000 ÷ $4,000,000 = 1.80

3.Last year's ROI = Net operating income ÷ Average operating assets = $504,000 ÷ $4,000,000 = 12.6%

or

ROI = Margin × Turnover = 7.0% × 1.80 = 12.6%

4.The margin for this year's investment opportunity is:

Margin = Net operating income ÷ Sales = $124,800 ÷ $1,560,000 = 8.0%

Margin = Net operating income ÷ Sales = $124,800 ÷ $1,560,000 = 8.0%5.The turnover for this year's investment opportunity is:

Turnover = Sales ÷ Average operating assets = $1,560,000 ÷ $1,200,000 = 1.30

6.The ROI for this year's investment opportunity is:

ROI = Net operating income ÷ Average operating assets = $124,800 ÷ $1,200,000 = 10.4%

or

ROI = Margin × Turnover = 8.0% × 1.30 = 10.4%

7.If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be:

Net operating income = $504,000 + $124,800 = $628,800

Sales = $7,200,000 + $1,560,000 = $8,760,000

Margin = Net operating income ÷ Sales = $628,800 ÷ $8,760,000 = 7.2%

8.If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

Sales = $7,200,000 + $1,560,000 = $8,760,000

Average operating assets = $4,000,000 + $1,200,000 = $5,200,000

Turnover = Sales ÷ Average operating assets = $8,760,000 ÷ $5,200,000 = 1.68

9.If the company pursues the investment opportunity and otherwise performs the same as last year, the ROI will be:

ROI = Net operating income ÷ Average operating assets = $628,800 ÷ $5,200,000 = 12.1%

or

ROI = Margin × Turnover = 7.2% × 1.68 = 12.1%

10.The CEO would not pursue the investment opportunity because it decreases the overall ROI.The owners of the company would not want the CEO to pursue the investment opportunity because its ROI is less than the company's minimum required rate of return.

Learning Objectives

- Gauge the return on investment (ROI) and interpret its significance.

- Investigate investment avenues by scrutinizing their residual income and ROI.