Asked by Osama Al-bahnasi on May 08, 2024

Verified

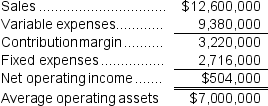

Craycraft Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $800,000 investment opportunity with the following characteristics:

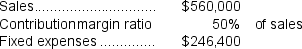

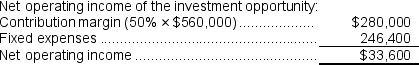

At the beginning of this year, the company has a $800,000 investment opportunity with the following characteristics:  Required:

Required:

1.What was last year's margin? (Round to the nearest 0.1%.)

2.What was last year's turnover? (Round to the nearest 0.01.)

3.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

5.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

6.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall ROI will this year? (Round to the nearest 0.1%.)

Margin

This is the difference between the selling price of a product and its cost, expressed as a percentage of the selling price.

Turnover

The speed at which a company's stock or assets are rotated or disposed of over a specific timeframe.

Return On Investment

An indicator used to assess the gain or loss generated from an investment relative to its cost.

- Determine the return on investment (ROI) and grasp its significance.

- Analyze investment options through the lens of residual income and ROI metrics.

Verified Answer

JW

Julia WitekMay 08, 2024

Final Answer :

1.Last year's Margin = Net operating income ÷ Sales = $504,000 ÷ $12,600,000 = 4.0%

2.Last year's Turnover = Sales ÷ Average operating assets = $12,600,000 ÷ $7,000,000 = 1.80

3.Last year's ROI = Net operating income ÷ Average operating assets = $504,000 ÷ $7,000,000 = 7.2% or ROI = Margin × Turnover = 4.0% × 1.80 = 7.2%

4.If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be: Net operating income = $504,000 + $33,600 = $537,600

Net operating income = $504,000 + $33,600 = $537,600

Sales = $12,600,000 + $560,000 = $13,160,000

Margin = Net operating income ÷ Sales = $537,600 ÷ $13,160,000 = 4.1%

5.If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

Sales = $12,600,000 + $560,000 = $13,160,000

Average operating assets = $7,000,000 + $800,000 = $7,800,000

Turnover = Sales ÷ Average operating assets = $13,160,000 ÷ $7,800,000 = 1.69

6.If the company pursues the investment opportunity and otherwise performs the same as last year, the ROI will be:

ROI = Net operating income ÷ Average operating assets = $537,600 ÷ $7,800,000 = 6.9%

or ROI = Margin × Turnover = 4.1% × 1.69 = 6.9%

2.Last year's Turnover = Sales ÷ Average operating assets = $12,600,000 ÷ $7,000,000 = 1.80

3.Last year's ROI = Net operating income ÷ Average operating assets = $504,000 ÷ $7,000,000 = 7.2% or ROI = Margin × Turnover = 4.0% × 1.80 = 7.2%

4.If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be:

Net operating income = $504,000 + $33,600 = $537,600

Net operating income = $504,000 + $33,600 = $537,600Sales = $12,600,000 + $560,000 = $13,160,000

Margin = Net operating income ÷ Sales = $537,600 ÷ $13,160,000 = 4.1%

5.If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

Sales = $12,600,000 + $560,000 = $13,160,000

Average operating assets = $7,000,000 + $800,000 = $7,800,000

Turnover = Sales ÷ Average operating assets = $13,160,000 ÷ $7,800,000 = 1.69

6.If the company pursues the investment opportunity and otherwise performs the same as last year, the ROI will be:

ROI = Net operating income ÷ Average operating assets = $537,600 ÷ $7,800,000 = 6.9%

or ROI = Margin × Turnover = 4.1% × 1.69 = 6.9%

Learning Objectives

- Determine the return on investment (ROI) and grasp its significance.

- Analyze investment options through the lens of residual income and ROI metrics.