Asked by Adriana PreciousLatina on May 30, 2024

Verified

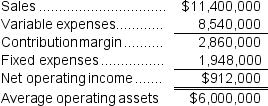

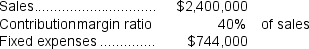

Willing Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1.What was last year's residual income?

2.What is the residual income of this year's investment opportunity?

3.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall residual income this year?

4.If Westerville's CEO earns a bonus only if residual income for this year exceeds residual income for last year, would the CEO pursue the investment opportunity?

Residual Income

Income that remains after subtracting all the cost of capital from the net operating profit.

Investment Opportunity

Any vehicle through which funds can be invested to potentially earn a return, such as stocks, bonds, real estate, or a business venture.

Minimum Required Rate

Often refers to the minimum rate of return that an investment must offer to be considered viable or the minimum acceptable compensation for delay or risk.

- Compute and evaluate residual income.

- Assess investment prospects by considering both residual income and return on investment.

Verified Answer

CK

Carly KaminskiJun 02, 2024

Final Answer :

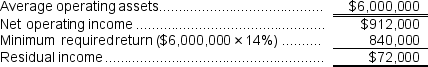

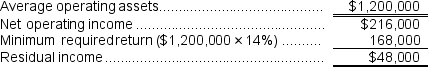

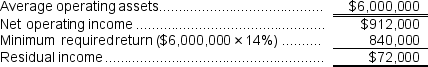

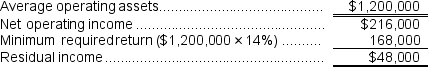

1.Last year's residual income was:

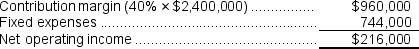

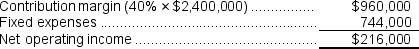

2.The residual income for this year's investment opportunity is:

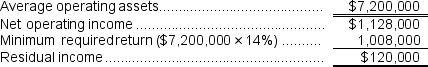

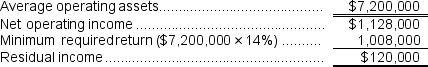

3.If the company pursues the investment opportunity, this year's residual income will be:

Average operating assets = $6,000,000 + $1,200,000 = $7,200,000

Net operating income = $912,000 + $216,000 = $1,128,000

4.The CEO would pursue the investment opportunity because residual income would increase by $48,000.

2.The residual income for this year's investment opportunity is:

3.If the company pursues the investment opportunity, this year's residual income will be:

Average operating assets = $6,000,000 + $1,200,000 = $7,200,000

Net operating income = $912,000 + $216,000 = $1,128,000

4.The CEO would pursue the investment opportunity because residual income would increase by $48,000.

Learning Objectives

- Compute and evaluate residual income.

- Assess investment prospects by considering both residual income and return on investment.