Asked by connor Xiong on Jun 19, 2024

Verified

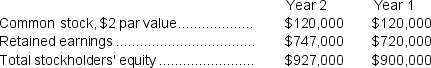

Linzey Corporation has provided the following data:  The company's net income in Year 2 was $33,000.The company's book value per share at the end of Year 2 is closest to:

The company's net income in Year 2 was $33,000.The company's book value per share at the end of Year 2 is closest to:

A) $22.45 per share

B) $12.45 per share

C) $0.55 per share

D) $15.45 per share

Book Value Per Share

A financial measure used to assess the per-share value of a company based on its equity available to common shareholders, divided by the number of outstanding shares.

Net Income

The total earnings of a company after all expenses and taxes have been deducted from revenue, representing the company's profitability over a specified period.

- Compute and elucidate equity multipliers.

- Determine and clarify the meaning of price-earnings ratios.

Verified Answer

NT

Nazrawit TesfayeJun 24, 2024

Final Answer :

D

Explanation :

Book value per share = (total shareholder equity - preferred equity) / number of common shares outstanding

Total shareholder equity = total assets - total liabilities

From the given data, we can calculate:

Total shareholder equity at the end of Year 2 = $260,000 - $155,000 = $105,000

Common shares outstanding = $180,000 / $30 = 6,000 shares

Book value per share = ($105,000 - 0) / 6,000 shares = $17.50 per share

Therefore, the closest answer choice is D) $15.45 per share.

Total shareholder equity = total assets - total liabilities

From the given data, we can calculate:

Total shareholder equity at the end of Year 2 = $260,000 - $155,000 = $105,000

Common shares outstanding = $180,000 / $30 = 6,000 shares

Book value per share = ($105,000 - 0) / 6,000 shares = $17.50 per share

Therefore, the closest answer choice is D) $15.45 per share.

Explanation :

Book value per share = Common stockholders' equity ÷ Number of common shares outstanding*

= $927,000 ÷ 60,000 shares = $15.45 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $120,000 ÷ $2 per share = 60,000 shares

= $927,000 ÷ 60,000 shares = $15.45 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $120,000 ÷ $2 per share = 60,000 shares

Learning Objectives

- Compute and elucidate equity multipliers.

- Determine and clarify the meaning of price-earnings ratios.

Related questions

Klein Corporation Has Provided the Following Data: the Company's ...

Rawdon Corporation's Net Operating Income in Year 2 Was $52,429 ...

Hernande Corporation Has Provided the Following Data: the Company's ...

Weightman Corporation's Net Operating Income in Year 2 Was $76,385 ...

Book Value Per Share Is Often Used as a Starting ...