Asked by Marie Brandt on Apr 29, 2024

Verified

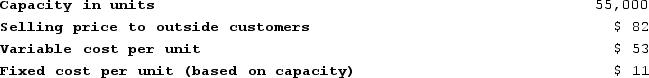

Wetherald Products, Incorporated, has a Pump Division that manufactures and sells a number of products, including a standard pump that could be used by another division in the company, the Pool Products Division, in one of its products. Data concerning that pump appear below:  The Pool Products Division is currently purchasing 4,000 of these pumps per year from an overseas supplier at a cost of $74 per pump.Assume that the Pump Division has enough idle capacity to handle all of the Pool Products Division's needs. What should be the minimum acceptable transfer price for the pumps from the standpoint of the Pump Division?

The Pool Products Division is currently purchasing 4,000 of these pumps per year from an overseas supplier at a cost of $74 per pump.Assume that the Pump Division has enough idle capacity to handle all of the Pool Products Division's needs. What should be the minimum acceptable transfer price for the pumps from the standpoint of the Pump Division?

A) $74 per unit

B) $53 per unit

C) $64 per unit

D) $82 per unit

Transfer Price

The price charged for goods or services transferred between divisions or branches of the same company.

Pump Division

A designated segment of a business focused on the production or sales of pumps.

Pool Products Division

A segment within a company focused on the development, production, and sales of products related to swimming pools.

- Familiarize oneself with the idea of transfer pricing and the aspects that shape the least allowable transfer price.

Verified Answer

In this case, the cost per unit for producing the pumps is not provided, but we can calculate it using the data given. The variable cost per unit is $27 ($1,080,000 ÷ 40,000 units), and the fixed cost per unit is $18 ($720,000 ÷ 40,000 units), making the total cost per unit $45 ($27 + $18).

Therefore, any transfer price above $45 would be acceptable from the standpoint of the Pump Division. However, we also need to consider the opportunity cost of selling to the Pool Products Division instead of selling on the open market. If the Pump Division were to sell the pumps on the open market, it could potentially receive a higher price than the cost per unit of $45.

Based on this information, the minimum acceptable transfer price would be:

Minimum acceptable transfer price = Total cost per unit + Opportunity cost per unit

Opportunity cost per unit = Potential revenue per unit - Total cost per unit

We do not know the potential revenue per unit in this case, but we do know that the Pool Products Division is currently purchasing 4,000 pumps per year from an overseas supplier at a cost of $74 per pump. If the Pump Division were to sell the pumps to the Pool Products Division for $74 per unit, the Pool Products Division would continue to purchase from the overseas supplier because the transfer price is higher than the current cost of purchasing from overseas.

Therefore, the opportunity cost of selling to the Pool Products Division is the contribution margin that would be lost by not selling on the open market. The contribution margin per unit is the selling price per unit minus the variable cost per unit, or $55 ($70 selling price - $15 variable cost).

Opportunity cost per unit = $55 - $45 = $10

Minimum acceptable transfer price = $45 + $10 = $55

Therefore, the minimum acceptable transfer price from the standpoint of the Pump Division is $55 per unit. The best choice is B) $53 per unit, which is slightly lower than the calculated minimum acceptable transfer price. This allows the Pool Products Division to save money compared to their current overseas supplier while still providing a profit to the Pump Division.

Learning Objectives

- Familiarize oneself with the idea of transfer pricing and the aspects that shape the least allowable transfer price.

Related questions

Wetherald Products, Incorporated, Has a Pump Division That Manufactures and ...

Steinhoff Products, Incorporated, Has a Sensor Division That Manufactures and ...

Determining the Transfer Price as the Price at Which the ...

Creaser Products, Incorporated, Has a Sensor Division That Manufactures and ...

When the Selling Division in an Internal Transfer Has Unsatisfied ...