Asked by Chih-Hsiang Chang on May 01, 2024

Verified

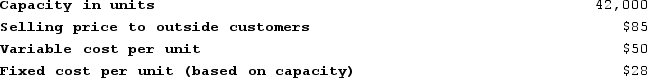

Creaser Products, Incorporated, has a Sensor Division that manufactures and sells a number of products, including a standard sensor. Data concerning that sensor appear below:

The company has a Safety Products Division that could use this sensor in one of its products. The Safety Products Division is currently purchasing 8,000 of these sensors per year from an overseas supplier at a cost of $76 per sensor.

The company has a Safety Products Division that could use this sensor in one of its products. The Safety Products Division is currently purchasing 8,000 of these sensors per year from an overseas supplier at a cost of $76 per sensor.

Required:

The Sensor Division is selling all of the sensors it can produce to outside customers. Also assume that $10 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. What is the acceptable range, if any, for the transfer price between the two divisions?

Sensor Division

A specialized business unit within a company focused on the development, production, and marketing of sensor technology.

Transfer Price

The fee applied to goods or services moved between various sections or units of the same enterprise.

Variable Expenses

Expenditures that adjust in relation to the business's operation level or production quantity.

- Understand the concept of transfer pricing and its range for transfers within a company.

Verified Answer

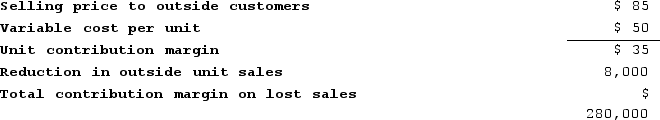

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:

From the perspective of the selling division, profits would increase as a result of the transfer if and only if:Transfer price > Variable cost per unit + (Total contribution margin on lost sales ÷ Number of units transferred)

Transfer price > $40 per unit + ($280,000 ÷ 8,000 units) = $40 per unit + $35 per unit = $75 per unit

From the perspective of the purchasing division, the transfer is financially attractive if and only if:

Transfer price < Cost of buying from outside supplier

Transfer price < $76 per unit

Combining the two requirements, the range of acceptable transfer prices is: $75 per unit < Transfer price < $76 per unit

Learning Objectives

- Understand the concept of transfer pricing and its range for transfers within a company.

Related questions

Two of the Decentralized Divisions of Gamberi Electronics Corporation Are ...

Determining the Transfer Price as the Price at Which the ...

Lank Products, Incorporated, Has a Transmitter Division That Manufactures and ...

Shular Products, Incorporated, Has a Valve Division That Manufactures and ...

Fyodor Corporation Has a Parts Division That Does Work for ...