Asked by Nicholas Paradas on May 30, 2024

Verified

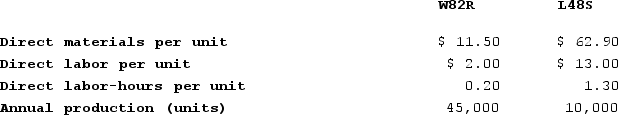

Werger Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, W82R and L48S, about which it has provided the following data:

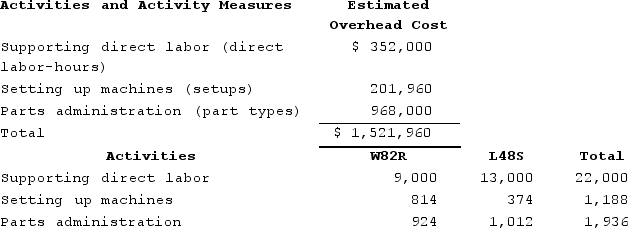

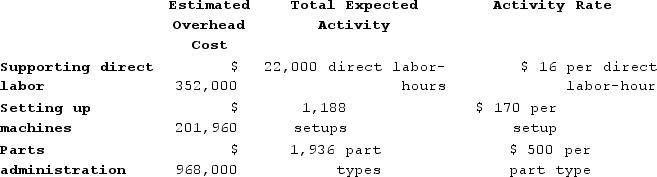

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labor-hours for the year is 22,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labor-hours for the year is 22,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

Required:a. Determine the unit product cost of each of the company's two products under the traditional costing system.b. Determine the unit product cost of each of the company's two products under activity-based costing system.

Required:a. Determine the unit product cost of each of the company's two products under the traditional costing system.b. Determine the unit product cost of each of the company's two products under activity-based costing system.

Manufacturing Overhead

These are indirect factory-related costs that are incurred when producing a product, such as utility costs, depreciation, and salaries of supervisors.

Direct Labor-Hours

Direct labor-hours refer to the total hours worked by employees directly involved in the production process.

Traditional Costing

An accounting method that applies indirect costs to products based on a predetermined overhead rate.

- Ascertain the per-unit expense of products through the application of conventional and activity-based costing techniques.

Verified Answer

ZK

Zybrea KnightJun 03, 2024

Final Answer :

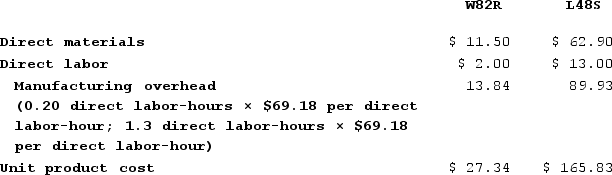

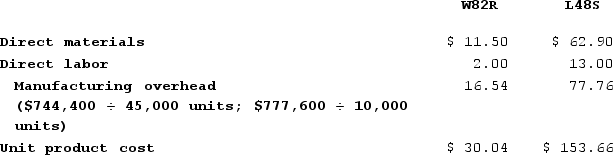

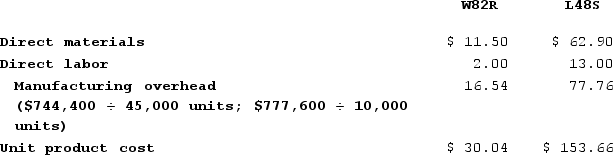

a. Traditional Unit Product CostsPredetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $1,521,960 ÷ 22,000 direct labor-hours = $69.18 per direct labor-hour

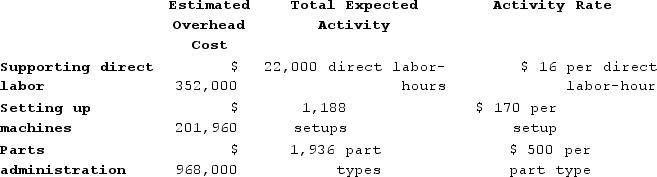

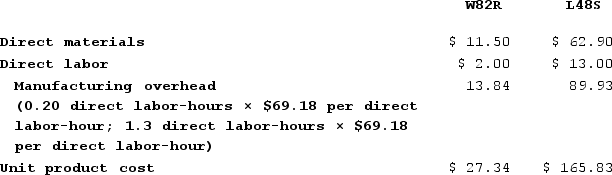

b. ABC Unit Product Costs.

b. ABC Unit Product Costs.

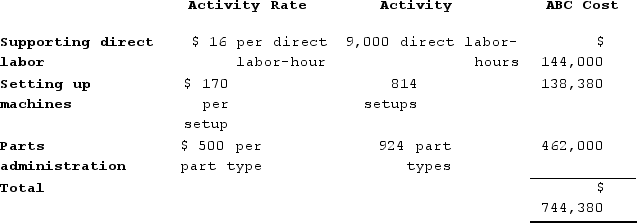

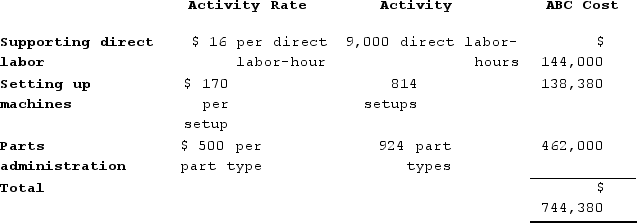

Overhead cost for W82R

Overhead cost for W82R

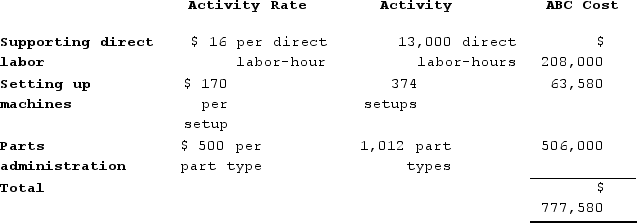

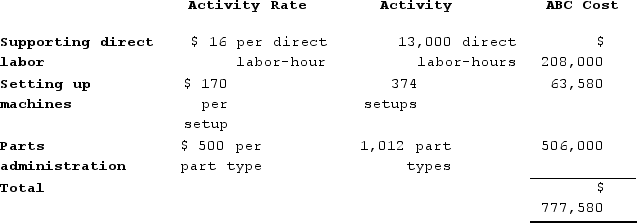

Overhead cost for L48S

Overhead cost for L48S

b. ABC Unit Product Costs.

b. ABC Unit Product Costs. Overhead cost for W82R

Overhead cost for W82R Overhead cost for L48S

Overhead cost for L48S

Learning Objectives

- Ascertain the per-unit expense of products through the application of conventional and activity-based costing techniques.