Asked by Zachary Zamborelli on Jul 13, 2024

Verified

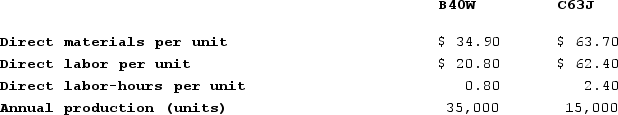

Torri Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, B40W and C63J, about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $2,656,000 and the company's estimated total direct labor-hours for the year is 64,000.

The company's estimated total manufacturing overhead for the year is $2,656,000 and the company's estimated total direct labor-hours for the year is 64,000.

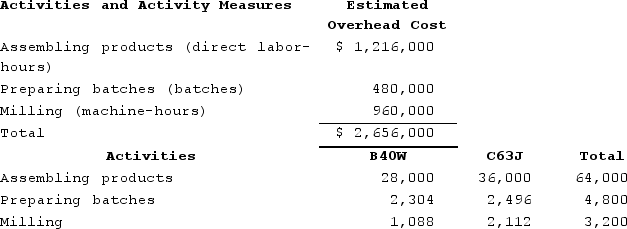

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

Required:a. Determine the unit product cost of each of the company's two products under the traditional costing system.b. Determine the unit product cost of each of the company's two products under activity-based costing system.

Required:a. Determine the unit product cost of each of the company's two products under the traditional costing system.b. Determine the unit product cost of each of the company's two products under activity-based costing system.

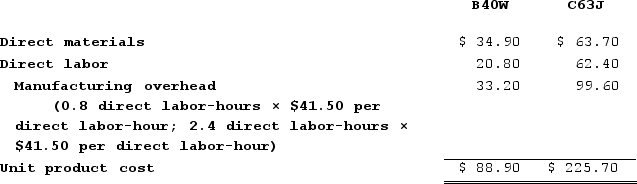

Traditional Costing

A costing method used for expense allocation in which the cost of products is based on the amount of manufacturing-related resources they consume, without differentiating between fixed and variable costs.

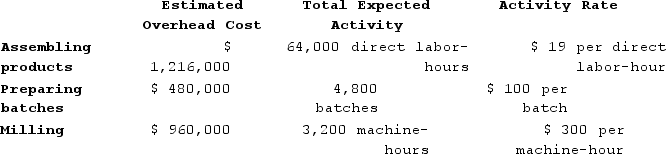

Activity-Based Costing

A costing method that identifies the activities in an organization and assigns the cost of each activity according to the actual consumption by each.

Manufacturing Overhead

includes all manufacturing costs that are not directly related to the production of goods, such as factory rent, utilities, and maintenance expenses.

- Acquire knowledge on the principles of activity-based costing (ABC) and how it is applied in distributing manufacturing overhead expenses.

- Determine the cost per unit of product using standard and activity-based costing systems.

Verified Answer

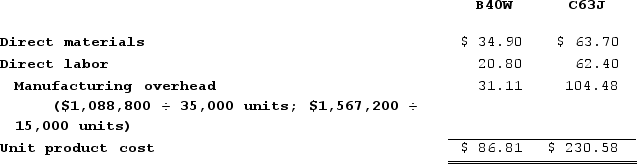

b. ABC Manufacturing Overhead Costs

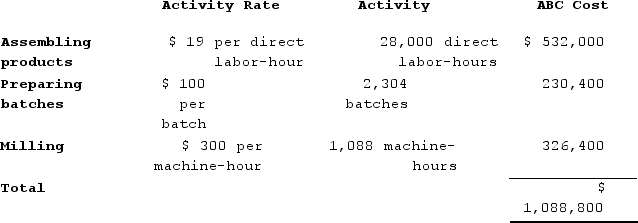

b. ABC Manufacturing Overhead Costs Overhead cost for B40W

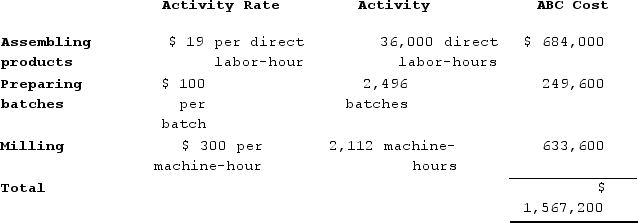

Overhead cost for B40W Overhead cost for C63J

Overhead cost for C63J

Learning Objectives

- Acquire knowledge on the principles of activity-based costing (ABC) and how it is applied in distributing manufacturing overhead expenses.

- Determine the cost per unit of product using standard and activity-based costing systems.

Related questions

Werger Manufacturing Corporation Has a Traditional Costing System in Which ...

Fletes Corporation Manufactures Two Products: Product O95C and Product M31N ...

Foster Florist Specializes in Large Floral Bouquets for Hotels and ...

Foster Florist Specializes in Large Floral Bouquets for Hotels and ...

What Is the Basic Principle Underlying Activity-Based Costing