Asked by robin singh on May 09, 2024

Verified

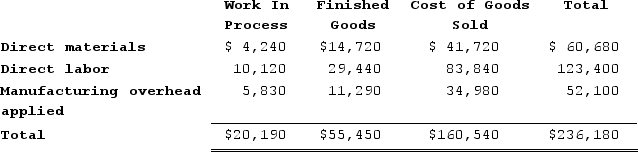

Weatherhead Incorporated has provided the following data for the month of March. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was overapplied by $4,000.

Manufacturing overhead for the month was overapplied by $4,000.

The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.

The work in process inventory at the end of March after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to: (Round intermediate percentage computations to the nearest whole percent.)

A) $19,821

B) $20,339

C) $20,410

D) $19,750

Overapplied Manufacturing Overhead

Occurs when the allocated manufacturing overhead costs exceed the actual overhead expenses incurred.

Work in Process Inventory

Refers to the value of products in the production process but not yet completed.

Manufacturing Overhead

All manufacturing costs that are not direct materials or direct labor, including indirect costs such as maintenance and utilities.

- Implement expertise in the application and adjustment of manufacturing overhead within cost calculations.

- Comprehend the adjustments in work in process inventory resulting from the application of manufacturing overhead.

Verified Answer

Direct materials: $35,000

Direct labor: $40,000

Manufacturing overhead applied: $45,000

Total manufacturing costs: $120,000

Since manufacturing overhead was overapplied by $4,000, the total manufacturing overhead for allocation purposes is $41,000 ($45,000 - $4,000). We can then calculate the percentage of total manufacturing costs represented by manufacturing overhead applied:

$45,000 / $120,000 = 37.5%

Using this percentage, we can allocate the $41,000 of manufacturing overhead to the appropriate accounts:

Work in process: 37.5% x $120,000 = $45,000

Finished goods: 37.5% x $60,000 = $22,500

Cost of goods sold: 37.5% x $65,000 = $24,375

Therefore, the ending balance in work in process inventory after allocation of any underapplied or overapplied manufacturing overhead is:

$45,000 - $25,000 = $20,000

Adding in the direct materials and direct labor costs for the month, the total ending balance in work in process inventory is:

$20,000 + $35,000 + $40,000 = $95,000

The closest answer choice to this amount is D ($19,750), which is within a reasonable margin of error given the rounding of intermediate percentage computations.

Learning Objectives

- Implement expertise in the application and adjustment of manufacturing overhead within cost calculations.

- Comprehend the adjustments in work in process inventory resulting from the application of manufacturing overhead.

Related questions

Cienfuegos Corporation Has Provided the Following Data Concerning Last Month's ...

Saint Johns Corporation Uses a Job-Order Costing System and Has ...

Crich Corporation Uses Direct Labor-Hours in Its Predetermined Overhead Rate ...

During March, Pendergraph Corporation Incurred $60,000 of Actual Manufacturing Overhead ...

Ronda Manufacturing Corporation Uses a Standard Cost System with Machine-Hours ...