Asked by Joyce Beddingfield on May 10, 2024

Verified

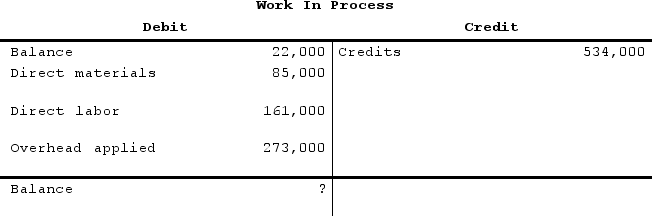

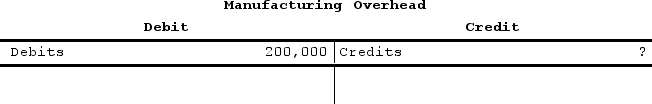

Saint Johns Corporation uses a job-order costing system and has provided the following partially completed summary T-accounts for the just completed period:

Manufacturing overhead for the period was:

Manufacturing overhead for the period was:

A) $7,000 Underapplied

B) $73,000 Underapplied

C) $73,000 Overapplied

D) $7,000 Overapplied

Job-Order Costing

A cost accounting system used to accumulate costs of production by job rather than by process, suitable for companies producing individual, custom orders.

T-Accounts

A graphical representation used in accounting to depict the debit and credit sides of an account.

Manufacturing Overhead

All indirect costs associated with manufacturing, such as utilities, maintenance, and salaries for management, not directly involved in the production.

- Employ strategies for the application and adjustment of manufacturing overhead within cost evaluations.

- Comprehend the use of job-order costing systems in manufacturing settings.

Verified Answer

Learning Objectives

- Employ strategies for the application and adjustment of manufacturing overhead within cost evaluations.

- Comprehend the use of job-order costing systems in manufacturing settings.

Related questions

Cienfuegos Corporation Has Provided the Following Data Concerning Last Month's ...

Weatherhead Incorporated Has Provided the Following Data for the Month ...

Crich Corporation Uses Direct Labor-Hours in Its Predetermined Overhead Rate ...

Normally a Job Cost Sheet Is Not Prepared for a ...

In a Job-Order Costing System, Direct Labour Costs Are Usually ...