Asked by Shakira Robertson on May 13, 2024

Verified

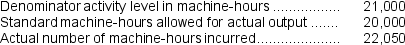

Ronda Manufacturing Corporation uses a standard cost system with machine-hours as the activity base for overhead.Last year, Ronda incurred $840,000 of fixed manufacturing overhead and generated a $42,000 favorable fixed manufacturing overhead budget variance.The following data relate to last year's operations:  What amount of total fixed manufacturing overhead cost did Ronda apply to production last year?

What amount of total fixed manufacturing overhead cost did Ronda apply to production last year?

A) $837,900

B) $840,000

C) $926,100

D) $972,405

Fixed Manufacturing Overhead

The set amount of costs for production that do not vary with the level of output, such as salaries of supervisors and rent of the factory building.

Budget Variance

The financial difference between the budgeted amount and the actual amount spent or received.

Standard Cost System

An accounting method that assigns preset costs to products and services, which are then compared to actual costs incurred.

- Employ conventional cost systems to determine the manufacturing overhead applied.

Verified Answer

$42,000 F = $840,000 - Budgeted fixed overhead

-$42,000 = $840,000 - Budgeted fixed overhead

Budgeted fixed overhead = $840,000 + $42,000

Budgeted fixed overhead = $882,000

Fixed component of the predetermined overhead rate = $882,000 ÷ 21,000 MHs = $42 per MH

Fixed manufacturing overhead cost applied to production = 20,000 MHs × $42 per MH = $840,000

Learning Objectives

- Employ conventional cost systems to determine the manufacturing overhead applied.

Related questions

During March, Pendergraph Corporation Incurred $60,000 of Actual Manufacturing Overhead ...

Sparacino Corporation Has Provided the Following Information: If 5,000 ...

If 5,000 Units Are Produced, the Total Amount of Manufacturing ...

Cienfuegos Corporation Has Provided the Following Data Concerning Last Month's ...

Crich Corporation Uses Direct Labor-Hours in Its Predetermined Overhead Rate ...