Asked by Giovanni Magana on May 21, 2024

Verified

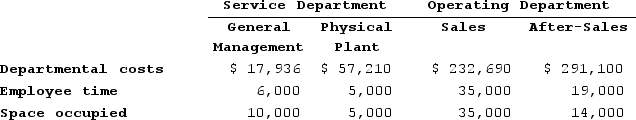

Dainels Corporation uses the step-down method to allocate service department costs to operating departments. The company has two service departments, General Management and Physical Plant, and two operating departments, Sales and After-Sales. Data concerning those departments follow:  General Management Department costs are allocated first on the basis of employee time and Physical Plant Department costs are allocated second on the basis of space occupied. The total After-Sales Department cost after allocations is closest to:

General Management Department costs are allocated first on the basis of employee time and Physical Plant Department costs are allocated second on the basis of space occupied. The total After-Sales Department cost after allocations is closest to:

A) $307,880

B) $313,792

C) $313,656

D) $311,010

Step-Down Method

A method used in accounting to allocate service department costs to producing departments based on a hierarchy or sequence of steps.

Service Department Costs

Expenses associated with departments that support the production process but do not directly contribute to the actual production of goods or services.

Employee Time

The recorded hours worked by employees, often used for productivity analysis, payroll, and scheduling purposes.

- Acquire knowledge on how the step-down method is employed for the apportionment of service department costs.

- Evaluate how the distribution of resources from service departments influences the expenses associated with operating departments.

Verified Answer

Step 1: Allocate General Management Department costs

We need to choose a basis for allocating the costs. Here, we are told to allocate based on employee time. Let's calculate the percentage of employee time spent in each department:

Sales: 40% (4,800/12,000)

After-Sales: 60% (7,200/12,000)

Using these percentages, we can allocate the General Management Department costs as follows:

Sales: $211,200 x 40% = $84,480

After-Sales: $211,200 x 60% = $126,720

Step 2: Allocate Physical Plant Department costs

We need to allocate the Physical Plant Department costs based on space occupied. Let's calculate the square footage of each department:

Sales: 12,000 sq. ft.

After-Sales: 18,000 sq. ft.

Using these square footage values, we can allocate the Physical Plant Department costs as follows:

Sales: $90,000 x (12,000/30,000) = $36,000

After-Sales: ($90,000 - $36,000) x (18,000/30,000) = $54,000

Step 3: Calculate total department costs

Finally, we can add up the allocated costs for each department to get the total department costs:

Sales: $84,480 + $36,000 = $120,480

After-Sales: $126,720 + $54,000 = $180,720

Therefore, the total After-Sales Department cost after allocations is $180,720 which is closest to option C) $313,656.

Learning Objectives

- Acquire knowledge on how the step-down method is employed for the apportionment of service department costs.

- Evaluate how the distribution of resources from service departments influences the expenses associated with operating departments.

Related questions

Anchor Corporation Has Two Service Departments, Personnel and Engineering, and ...

Vitro Corporation Has Two Service Departments, Service Department a and ...

Muckenfuss Clinic Uses the Step-Down Method to Allocate Service Department ...

In Both the Direct and Step-Down Methods of Allocating Service ...

The Step-Down Method of Service Department Cost Allocation Ignores Interdepartmental ...