Asked by Kylie Scott on Jun 22, 2024

Verified

Use the following tables to calculate the present value of a $25,000, 7%, 5-year bond that pays $1,750 ($25,000 × 7%) interest annually, if the market rate of interest is 7%

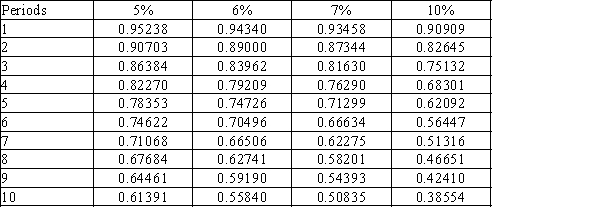

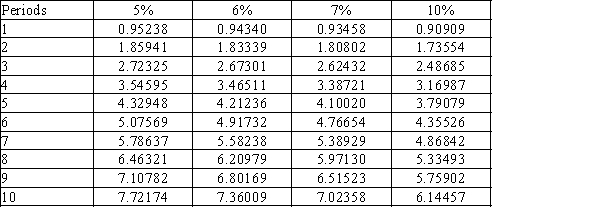

Present Value of $1 at Compound Interest  Present Value of Annuity of $1 at Compound Interest

Present Value of Annuity of $1 at Compound Interest

Present Value

The present valuation of a future financial sum or cash flow series, factoring in a specific return rate.

Compound Interest

Interest earned on both the initial principal and the accumulated interest from previous periods on a deposit or loan.

Bond

A financial instrument in which an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period at a specified interest rate.

- Understand the principles of bond valuation and the calculation of present value for single amounts and annuities.

Verified Answer

TF

Tyrese FranklinJun 27, 2024

Final Answer :

Present value of face value of $25,000 due in 5 years at 7%

compounded annually

$25,000 × 0.71299 (present value factor of $1 for 5 periods at 7%)

$17,825*

Present value of 5 annual interest payments of $1,750 at 7%

interest compounded annually

$1,750 × 4.10020 (present value of annuity of $1 for 5 periods at 7%) 7,175*

Total present value of bonds

$25,000*

*rounded

compounded annually

$25,000 × 0.71299 (present value factor of $1 for 5 periods at 7%)

$17,825*

Present value of 5 annual interest payments of $1,750 at 7%

interest compounded annually

$1,750 × 4.10020 (present value of annuity of $1 for 5 periods at 7%) 7,175*

Total present value of bonds

$25,000*

*rounded

Learning Objectives

- Understand the principles of bond valuation and the calculation of present value for single amounts and annuities.