Asked by Radiate Waldemariam on Jun 15, 2024

Verified

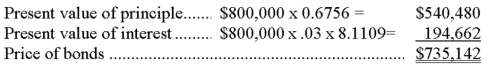

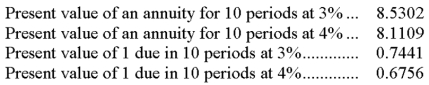

A company issues bonds with a par value of $800,000 on their issue date. The bonds mature in 5 years and pay 6% annual interest in two semiannual payments. On the issue date, the market rate of interest is 8%. Compute the price of the bonds on their issue date. The following information is taken from present value tables:

Semiannual Payments

Payments that are made twice a year, commonly found in the context of bonds or loan agreements.

- Recognize the impact of market interest rate changes on bond pricing and issuance proceeds.

- Calculate the present worth of annuities and one-off payments, leveraging this analysis in the evaluation of bonds and loans.

Verified Answer

PR

Learning Objectives

- Recognize the impact of market interest rate changes on bond pricing and issuance proceeds.

- Calculate the present worth of annuities and one-off payments, leveraging this analysis in the evaluation of bonds and loans.

Related questions

On January 1, a Company Issues Bonds with a Par ...

Shin Company Has a Loan Agreement That Provides It with ...

Hornet Corporation Has a Loan Agreement That Provides It with ...

On January 1,a Company Issues 8%,5-Year,$300,000 Bonds That Pay Interest ...

Vince Has $35,000 to Purchase an Annuity That Will Provide ...