Asked by garrett miles on Jun 20, 2024

Verified

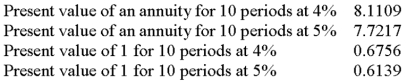

On January 1, a company issues bonds with a par value of $300,000. The bonds mature in 5 years, and pay 8% annual interest, payable each June 30 and December 31. On the issue date, the market rate of interest for the bonds is 10%. Compute the price of the bonds on their issue date. The following information is taken from present value tables:

Present Value Tables

A set of tables used to calculate the present value of an amount of money to be received in the future by taking into account a specific interest rate.

- Identify the effects of fluctuations in market interest rates on the valuation and issuance returns of bonds.

- Ascertain the present value of annuities and lone payments, applying these determinations to bond and loan appraisals.

Verified Answer

FA

Firman AkbarJun 26, 2024

Final Answer :

Present value of principal $300,000 x 0.6139 = $184,170

Present value of interest $300,000 x 0.04 x 7.7217 = 92,660

Selling price of the bond $276,830

Present value of interest $300,000 x 0.04 x 7.7217 = 92,660

Selling price of the bond $276,830

Learning Objectives

- Identify the effects of fluctuations in market interest rates on the valuation and issuance returns of bonds.

- Ascertain the present value of annuities and lone payments, applying these determinations to bond and loan appraisals.

Related questions

A Company Issues Bonds with a Par Value of $800,000 ...

Shin Company Has a Loan Agreement That Provides It with ...

Hornet Corporation Has a Loan Agreement That Provides It with ...

On January 1,a Company Issues 8%,5-Year,$300,000 Bonds That Pay Interest ...

Vince Has $35,000 to Purchase an Annuity That Will Provide ...