Asked by BRANDI PRINCE on Apr 26, 2024

Verified

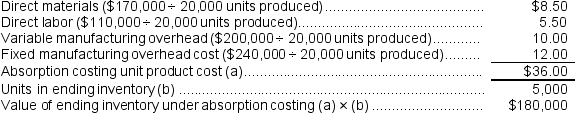

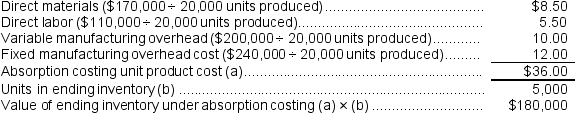

Under absorption costing, the ending inventory for the year would be valued at:

A) $0

B) $216,000

C) $248,250

D) $180,000

Absorption Costing

A costing approach that integrates both direct and indirect costs associated with manufacturing into the product's total cost.

Ending Inventory

The value of the goods available for sale at the end of an accounting period, calculated as beginning inventory plus purchases minus cost of goods sold.

- Examine the effect that steady manufacturing overhead charges have on stock quantities and operational profit.

Verified Answer

LA

Laila A RasoolApr 28, 2024

Final Answer :

D

Explanation :

Units in ending inventory = Units in beginning inventory + Units produced - Units sold

= 0 +20,000 units - 15,000 units = 5,000 units

= 0 +20,000 units - 15,000 units = 5,000 units

Learning Objectives

- Examine the effect that steady manufacturing overhead charges have on stock quantities and operational profit.