Asked by Nicholas Malmquist on Apr 26, 2024

Verified

Under absorption costing, the cost of goods sold for the year would be:

A) $258,400

B) $394,400

C) $353,600

D) $398,400

Absorption Costing

A method of inventory costing in which all costs of production (both variable and fixed) are treated as product costs.

Cost Of Goods Sold

An accounting term representing the direct costs attributable to the production of goods sold by a company, including materials and labor.

- Examine the effect of constant manufacturing overhead costs on the valuation of inventory and the net income from operations.

Verified Answer

TA

Theodora AmorkorMay 01, 2024

Final Answer :

B

Explanation :

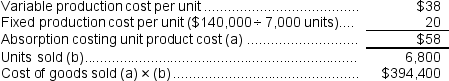

Under absorption costing, the cost of goods sold includes both variable and fixed manufacturing costs. Therefore, we need to add up the total manufacturing costs (both variable and fixed) for the year, which are:

Direct materials - $60,000

Direct labor - $90,000

Variable manufacturing overhead - $72,000

Fixed manufacturing overhead - $172,000

Total manufacturing costs = $394,000

Then, we subtract the ending inventory from the total manufacturing costs to get the cost of goods sold:

$394,000 - $600 = $393,400

The closest answer choice is B, which is $394,400.

Direct materials - $60,000

Direct labor - $90,000

Variable manufacturing overhead - $72,000

Fixed manufacturing overhead - $172,000

Total manufacturing costs = $394,000

Then, we subtract the ending inventory from the total manufacturing costs to get the cost of goods sold:

$394,000 - $600 = $393,400

The closest answer choice is B, which is $394,400.

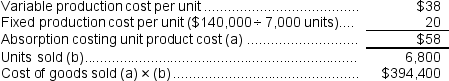

Explanation :  Reference: CHO7-Ref23

Reference: CHO7-Ref23

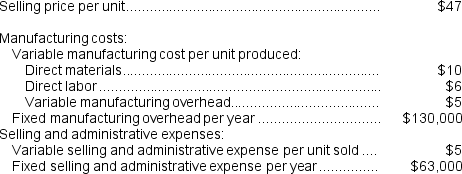

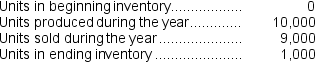

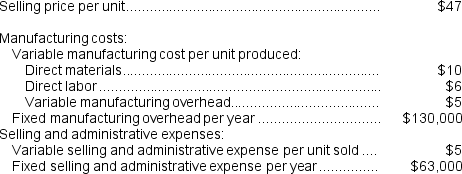

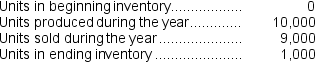

Baraban Corporation has provided the following data for its most recent year of operation:

Reference: CHO7-Ref23

Reference: CHO7-Ref23Baraban Corporation has provided the following data for its most recent year of operation:

Learning Objectives

- Examine the effect of constant manufacturing overhead costs on the valuation of inventory and the net income from operations.