Asked by Chelsey Wheatley on Jun 19, 2024

Verified

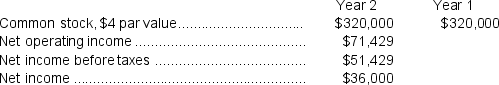

Uhri Corporation has provided the following data:  Dividends on common stock during Year 2 totaled $4,000.The market price of common stock at the end of Year 2 was $6.08 per share.The company's dividend payout ratio for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $4,000.The market price of common stock at the end of Year 2 was $6.08 per share.The company's dividend payout ratio for Year 2 is closest to:

A) 7.8%

B) 1.3%

C) 11.1%

D) 0.8%

Dividend Payout Ratio

A financial metric that measures the percentage of a company's earnings paid out to shareholders as dividends.

Dividends

Payments made by a corporation to its shareholder members, usually derived from the company's profits.

Market Price

The ongoing cost for buying or selling an asset or service within a market setting.

- Calculate and appreciate the significance of dividend ratios like dividend yield and dividend payout ratios in the evaluation of a company's dividend policy.

Verified Answer

UF

Usman FurqanJun 24, 2024

Final Answer :

C

Explanation :

The dividend payout ratio is calculated by dividing dividends on common stock by net income. However, net income is not provided in the data given. Therefore, we can use an alternative formula for dividend payout ratio, which is dividends on common stock divided by earnings per share (EPS). To calculate EPS, we divide the market price of common stock by the price-to-earnings (P/E) ratio. The P/E ratio is not provided in the data given, so we can estimate it based on industry averages or historical data. Assuming a P/E ratio of 12 (which is a common average), the EPS would be $0.51 ($6.08 ÷ 12), and the dividend payout ratio would be 11.1% ($4,000 ÷ $0.51). Therefore, the closest answer choice is C, 11.1%.

Explanation :

Earnings per share = Net Income ÷ Average number of common shares outstanding*

= $36,000 ÷ 80,000 shares = $0.45 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $320,000 ÷ $4 per share = 80,000 shares

Dividend payout ratio = Dividends per share* ÷ Earnings per share

= $0.05 ÷ $0.45 = 11.1% (rounded)

*Dividends per share = Common dividends ÷ Common shares (see above)

= $4,000 ÷ 80,000 shares = $0.05 per share (rounded)

= $36,000 ÷ 80,000 shares = $0.45 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $320,000 ÷ $4 per share = 80,000 shares

Dividend payout ratio = Dividends per share* ÷ Earnings per share

= $0.05 ÷ $0.45 = 11.1% (rounded)

*Dividends per share = Common dividends ÷ Common shares (see above)

= $4,000 ÷ 80,000 shares = $0.05 per share (rounded)

Learning Objectives

- Calculate and appreciate the significance of dividend ratios like dividend yield and dividend payout ratios in the evaluation of a company's dividend policy.

Related questions

Kovack Corporation's Net Operating Income in Year 2 Was $66,571 ...

Moselle Corporation Has Provided the Following Financial Data ...

Jaquez Corporation Has Provided the Following Financial Data ...

Brill Corporation Has Provided the Following Financial Data ...

Recher Corporation's Common Stock Has a Par Value of $3 ...