Asked by Alyamamah Saleh on Jun 03, 2024

Verified

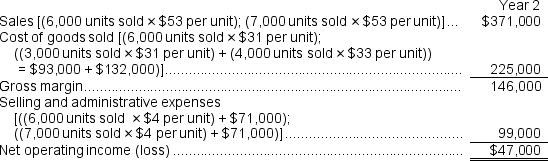

The net operating income (loss) under absorption costing in Year 2 is closest to:

A) $146,000

B) $118,000

C) $47,000

D) $41,000

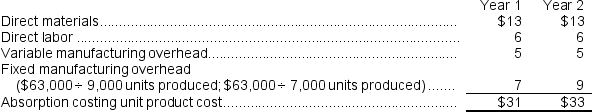

Absorption Costing

A method in accounting that adds all the manufacturing-related expenses like direct materials, direct labor, and all types of overhead (both variable and fixed) to the cost of a product.

Net Operating Income

Profit generated from a company's core business operations, excluding costs and income from non-operational activities.

Operating Loss

A situation where a business's total expenses exceed its revenues, not accounting for interest or taxes.

- Calculate the profit from operations according to variable and absorption costing systems.

Verified Answer

Absorption costing income statement:

Absorption costing income statement:

Learning Objectives

- Calculate the profit from operations according to variable and absorption costing systems.

Related questions

The Net Operating Income (Loss)under Variable Costing in Year 2 ...

The Net Operating Income (Loss)under Absorption Costing Is Closest To

The Net Operating Income (Loss)under Absorption Costing Closest To

The Net Operating Income (Loss)under Variable Costing in Year 2 ...

What Is the Net Operating Income for the Month Under ...