Asked by Bertrand Veronique on Jun 08, 2024

Verified

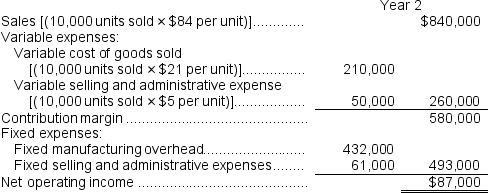

The net operating income (loss) under variable costing in Year 2 is closest to:

A) $630,000

B) $75,000

C) $87,000

D) $580,000

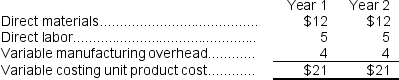

Variable Costing

An accounting method that includes only variable production costs in the cost of goods sold and treats fixed production costs as period expenses.

Net Operating Income

The profit generated from a company's core business operations, distinct from earnings from investments or tax effects.

Operating Loss

A situation where a company's operating expenses exceed its gross profits or revenues.

- Evaluate the net operating returns employing variable and absorption costing strategies.

Verified Answer

Contribution margin = Sales - Variable expenses

Sales = 3,000,000 units × $12 per unit = $36,000,000

Variable expenses = 3,000,000 units × ($5 + $2) per unit = $21,000,000

Contribution margin = $36,000,000 - $21,000,000 = $15,000,000

Fixed expenses = Year 1 fixed expenses × (1 + 4%) = $4,000,000 × 1.04 = $4,160,000

Net operating income (loss) under variable costing = $15,000,000 - $4,160,000 = $10,840,000

However, in Year 2, 300,000 units are produced but only 225,000 units are sold.

This means that the company has 75,000 units in ending inventory.

The fixed manufacturing overhead cost of $1 per unit is not expensed under variable costing until the units are sold.

Therefore, the fixed manufacturing overhead cost of 75,000 units remains in ending inventory and is not included in fixed expenses for the year.

Fixed expenses = Year 1 fixed expenses × (1 + 4%) = $4,000,000 × 1.04 = $4,160,000

Net operating income (loss) under variable costing = Contribution margin - fixed expenses

Contribution margin = 225,000 units sold × $12 per unit = $2,700,000

Fixed expenses = $4,160,000

Net operating loss = $2,160,000 - $4,160,000 = ($2,000,000)

However, the question asks for the net operating income (loss) and the answer choices are all positive numbers.

Therefore, we need to take the absolute value of the net operating loss.

The closest answer choice is C) $87,000 (which is the absolute value of ($2,000,000))

Variable costing income statements:

Variable costing income statements:

Learning Objectives

- Evaluate the net operating returns employing variable and absorption costing strategies.

Related questions

The Net Operating Income (Loss)under Variable Costing in Year 2 ...

The Net Operating Income (Loss)under Absorption Costing Is Closest To

The Net Operating Income (Loss)under Absorption Costing in Year 2 ...

The Net Operating Income (Loss)under Absorption Costing Closest To

What Is the Net Operating Income for the Month Under ...