Asked by Christie Stephenie on Jun 07, 2024

Verified

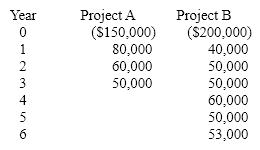

The projected cash flows for two mutually exclusive projects are as follows:

If the cost of capital is 10%, does the equivalent annual annuity method give a clear indication of which project should be undertaken? Calculate the EAAs for both projects and comment on the result

If the cost of capital is 10%, does the equivalent annual annuity method give a clear indication of which project should be undertaken? Calculate the EAAs for both projects and comment on the result

Equivalent Annual Annuity

A financial calculation used to compare projects with different lifespans, by converting their net present values into equal yearly payments.

Cost of Capital

The essential yield required to validate the investment in a project involving capital budgeting, like erecting a new manufacturing plant.

Mutually Exclusive

Situations or options that cannot occur or be chosen at the same time, often requiring a choice to be made between them for decision-making purposes.

- Gain insight into the foundational principles and applications of the Net Present Value (NPV) and Equivalent Annual Annuity (EAA) technique for appraising projects.

- Analyze cash flow projections to determine the viability of projects through various capital budgeting techniques.

Verified Answer

A. NPV: CFo = -150,000, C01 = 80,000, C02 = 60,000, C03 = 50,000; NPV: I = 10

NPV = $9,880

EAA PV = 9,880, N = 3, I/Y=10; solve for PMT = $3,973 = EAA

B. NPV: CFo = -200,000, C01 = 40,000, C02 = 50,000, C03 = 50,000; C04 = 60,000, C05 = 50,000, C06 = 53,000, NPV: I = 10

NPV = $17,196

EAA PV = 17,196, N = 6, I/Y=10; solve for PMT = $3,948 = EAA

The calculations indicate project A to be the better choice, but the margin is far too small to be significant. Essentially the EAA method is saying the projects are financially equivalent.

Learning Objectives

- Gain insight into the foundational principles and applications of the Net Present Value (NPV) and Equivalent Annual Annuity (EAA) technique for appraising projects.

- Analyze cash flow projections to determine the viability of projects through various capital budgeting techniques.

Related questions

Use the Following Information for the Next Three Questions: Nelson ...

Scanlon Inc A)$14659 B)$154 ...

The Management of Opray Corporation Is Considering the Purchase of ...

Jojola Corporation Is Investigating Buying a Small Used Aircraft for ...

PEI Corp's Management Has Determined That Two Independent Projects Have ...