Asked by Adeeb Ebaad on May 10, 2024

Verified

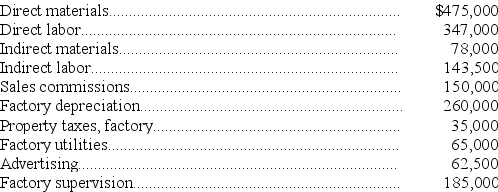

The predetermined overhead rate for Shilling Manufacturing is based on estimated direct labor costs of $350,000 and estimated factory overhead of $770,000.Actual costs incurred were:

a.Calculate the predetermined overhead rate and calculate the overhead applied during the year.

a.Calculate the predetermined overhead rate and calculate the overhead applied during the year.

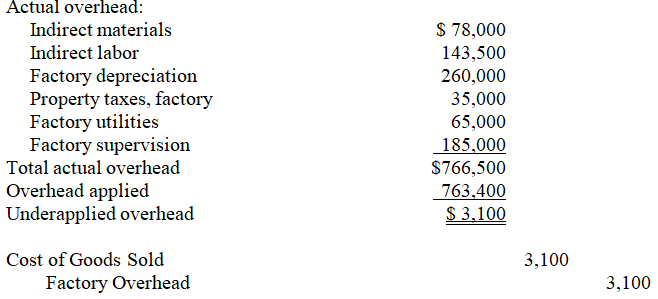

b.Prepare the journal entry to eliminate the over- or underapplied overhead,assuming that it is not material in amount.

Predetermined Overhead Rate

A rate used to assign overhead costs to products or jobs, calculated before the period begins based on an estimate of costs.

Overapplied Overhead

A scenario in which the overhead costs attributed to manufacturing exceed the overhead expenses that were actually incurred.

Underapplied Overhead

A situation where the allocated factory overhead costs are less than the actual overhead costs incurred, leading to a discrepancy in cost accounting.

- Compute and elucidate the occurrence of over- or underapplied overhead within a job order costing framework.

- Calculate the preset overhead rate by employing various estimated and actual expenses.

Verified Answer

Overhead applied = $347,000 * 220% = $763,400

b.

Learning Objectives

- Compute and elucidate the occurrence of over- or underapplied overhead within a job order costing framework.

- Calculate the preset overhead rate by employing various estimated and actual expenses.

Related questions

The Following Information About the Zhang Company Is Available on ...

Kiker Incorporated Makes a Single Product--An Electrical Motor Used in ...

Gallucci Incorporated Makes a Single Product--A Critical Part Used in ...

The Marlow Corporation Uses a Standard Cost System and Applies ...

Landis Company Uses a Job Order Cost System in Each ...