Asked by Logan perry on May 11, 2024

Verified

Landis Company uses a job order cost system in each of its two manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department A and machine hours in Department B. In establishing the predetermined overhead rates for 2017 the following estimates were made for the year:

During January the job cost sheet showed the following costs and production data: Department AB Direct materials used $195,000$128,000 Direct labor cost $195,000110,000 Manufacturing overhead incurred 100,000135,000 Direct labor hours 130,0008,400 Machine hours 8,00034,000\begin{array} { l r r } & { \text { Department } } \\& \mathrm { A }& \mathrm { B }\\\text { Direct materials used } & \$195,000& \$ 128,000 \\\text { Direct labor cost } & \$ 195,000 & 110,000 \\\text { Manufacturing overhead incurred } & 100,000 & 135,000 \\\text { Direct labor hours } & 130,000 & 8,400 \\\text { Machine hours } & 8,000 & 34,000\end{array} Direct materials used Direct labor cost Manufacturing overhead incurred Direct labor hours Machine hours Department A$195,000$195,000100,000130,0008,000B$128,000110,000135,0008,40034,000 Instructions

(a) Compute the predetermined overhead rate for each department.

(b) Compute the total manufacturing cost assigned to jobs in January in each department.

(c) Compute the balance in the Manufacturing Overhead account at the end of January and indicate whether overhead is over- or underapplied.

Predetermined Overhead Rate

A rate used to apply manufacturing overhead costs to products or job orders, calculated before the periods in which it is applied.

Manufacturing Overhead

All indirect costs associated with the manufacturing process, including but not limited to utilities, depreciation, and salaries of supervisors.

Direct Labor

Refers to the wages and benefits of employees who are directly involved in the production of goods.

- Exhibit proficiency in preparing and examining job cost records.

- Work out and enact overhead expenses utilizing established overhead rates in advance.

- Review the effects that underapplied or overapplied overhead exerts on financial statements.

Verified Answer

Department A (using direct labor cost): $2,100,000÷$1,500,000=140%\$ 2,100,000 \div \$ 1,500,000 = 140 \%$2,100,000÷$1,500,000=140%

Department B (using machine hours): $1,400,000÷400,000=$3.50\$ 1,400,000 \div 400,000 = \$ 3.50$1,400,000÷400,000=$3.50 per machine hour

(b) Total manufacturing costs by department:

Department A: Direct materials $195,000 Direct labor cost 100,000 Manufacturing overhead applied ($100,000×140%)140,000 Total manufacturing costs $435,000\begin{array}{ll}\text { Department A: }\\\text { Direct materials } & \$ 195,000 \\ \text { Direct labor cost } & 100,000 \\ \text { Manufacturing overhead applied }(\$ 100,000 \times 140 \%) & 140,000 \\ \text { Total manufacturing costs } & \$ 435,000 \\\end{array} Department A: Direct materials Direct labor cost Manufacturing overhead applied ($100,000×140%) Total manufacturing costs $195,000100,000140,000$435,000

Department B: Direct materials $128,000 Direct labor cost 110,000 Manufacturing overhead applied ($34,000×$3.50)119,000 Total manufacturing costs $357,000\begin{array}{ll}\text { Department B: }\\\text { Direct materials } & \$ 128,000 \\ \text { Direct labor cost } & 110,000 \\ \text { Manufacturing overhead applied }(\$ 34,000 \times \$3.50) & 119,000 \\ \text { Total manufacturing costs } & \$ 357,000 \\\end{array} Department B: Direct materials Direct labor cost Manufacturing overhead applied ($34,000×$3.50) Total manufacturing costs $128,000110,000119,000$357,000

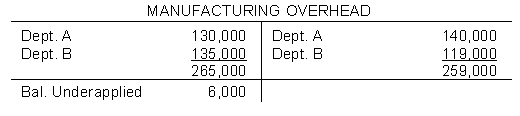

(c)

Learning Objectives

- Exhibit proficiency in preparing and examining job cost records.

- Work out and enact overhead expenses utilizing established overhead rates in advance.

- Review the effects that underapplied or overapplied overhead exerts on financial statements.

Related questions

If Actual Manufacturing Overhead Was Greater Than the Amount of ...

Mike Hilyer Is Confused About Under and Overapplied Manufacturing Overhead ...

Martin Company Applies Manufacturing Overhead Based on Direct Labor Hours ...

If the Manufacturing Overhead Account Has a Debit Balance at ...

Alberta Corporation Uses a Job-Order Costing System ...