Asked by mackenzie maison on Jun 12, 2024

Verified

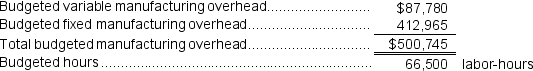

Gallucci Incorporated makes a single product--a critical part used in commercial airline seats.The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period.Data concerning the most recent year appear below:  The predetermined overhead rate is closest to:

The predetermined overhead rate is closest to:

A) $7.53 per labor-hour

B) $7.85 per labor-hour

C) $14.31 per labor-hour

D) $14.92 per labor-hour

Predetermined Overhead Rate

A rate calculated before a period begins, used to allocate manufacturing overhead costs to products based on a related activity.

Electrical Motor

A device that converts electrical energy into mechanical energy, commonly used in a wide range of applications from household appliances to industrial machinery.

Standard Labor-Hours

The estimated time that should be required to complete a single unit of production, serving as a benchmark for performance and cost control.

- Employ the predefined overhead rate in the computation of costs.

Verified Answer

Learning Objectives

- Employ the predefined overhead rate in the computation of costs.

Related questions

The Marlow Corporation Uses a Standard Cost System and Applies ...

Kiker Incorporated Makes a Single Product--An Electrical Motor Used in ...

The Predetermined Overhead Rate for Shilling Manufacturing Is Based on ...

Landis Company Uses a Job Order Cost System in Each ...

Martin Company Applies Manufacturing Overhead Based on Direct Labor Hours ...