Asked by Rachel Sawyer on Jul 06, 2024

Verified

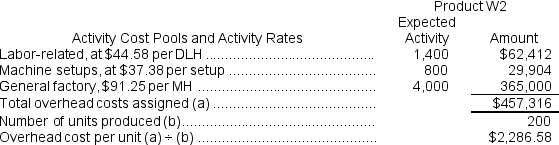

The overhead applied to each unit of Product W2 under activity-based costing is closest to:

A) $2,286.58 per unit

B) $1,126.79 per unit

C) $995.09 per unit

D) $1,825.00 per unit

Activity-Based Costing

is a method of accounting that assigns costs to products based on the activities they require, aiming to provide more accurate product costing.

- Ascertain the overhead allocation for certain products through activity-based costing methods.

Verified Answer

CM

Chris McNattJul 11, 2024

Final Answer :

A

Explanation :

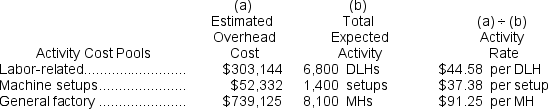

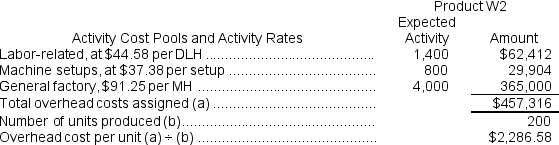

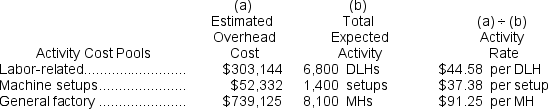

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Reference: CH04-Ref9

Reference: CH04-Ref9

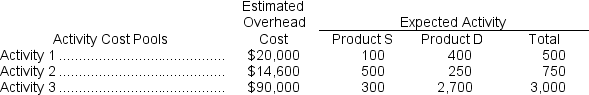

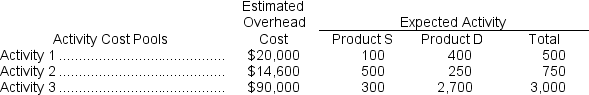

Arthur Company has two products: S and D.The company uses activity-based costing and has prepared the following analysis showing the estimated total cost and expected activity for each of its three activity cost pools: The annual production and sales of Product S is 4,547 units.The annual production and sales of Product D is 7,913.

The annual production and sales of Product S is 4,547 units.The annual production and sales of Product D is 7,913.

Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Reference: CH04-Ref9

Reference: CH04-Ref9Arthur Company has two products: S and D.The company uses activity-based costing and has prepared the following analysis showing the estimated total cost and expected activity for each of its three activity cost pools:

The annual production and sales of Product S is 4,547 units.The annual production and sales of Product D is 7,913.

The annual production and sales of Product S is 4,547 units.The annual production and sales of Product D is 7,913.

Learning Objectives

- Ascertain the overhead allocation for certain products through activity-based costing methods.

Related questions

The Overhead Applied to Each Unit of Product H9 Under ...

The Total Overhead Applied to Product E1 Under Activity-Based Costing ...

The Total Overhead Applied to Product A7 Under Activity-Based Costing ...

The Overhead Applied to Each Unit of Product K0 Under ...

The Total Overhead Applied to Product P4 Under Activity-Based Costing ...