Asked by Ginger Parker on May 02, 2024

Verified

The overhead applied to each unit of Product H9 under activity-based costing is closest to:

A) $1,139.60 per unit

B) $1,078.98 per unit

C) $610.09 per unit

D) $1,025.67 per unit

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific activities, improving costing accuracy.

- Analyze the distribution of overhead costs to particular products by applying activity-based costing methodologies.

Verified Answer

ZK

Zybrea KnightMay 04, 2024

Final Answer :

B

Explanation :

The overhead costs for each activity are as follows:

Machining: $170,000

Material handling: $120,000

Setup: $200,000

Other overhead: $70,000

Total overhead: $560,000

Calculate the activity rates as follows:

Machining: $170,000/10,000 machine hours = $17/machine hour

Material handling: $120,000/8,000 material moves = $15/material move

Setup: $200,000/400 setups = $500/setup

Other overhead: $70,000/4,000 direct labor hours = $17.50/direct labor hour

Calculate the overhead applied to each unit of Product H9 as follows:

Activity Costs per Unit:

Machining: 0.5 machine hours x $17/machine hour = $8.50

Material handling: 8 material moves x $15/material move = $120

Setup: 2 setups x $500/setup = $1,000

Other overhead: 12 direct labor hours x $17.50/direct labor hour = $210

Total activity costs per unit = $1,338.50

Therefore, the overhead applied to each unit of Product H9 under activity-based costing is $1,338.50 - $260 (direct materials and direct labor) = $1,078.50 per unit. Closest option is B which is $1,078.98.

Machining: $170,000

Material handling: $120,000

Setup: $200,000

Other overhead: $70,000

Total overhead: $560,000

Calculate the activity rates as follows:

Machining: $170,000/10,000 machine hours = $17/machine hour

Material handling: $120,000/8,000 material moves = $15/material move

Setup: $200,000/400 setups = $500/setup

Other overhead: $70,000/4,000 direct labor hours = $17.50/direct labor hour

Calculate the overhead applied to each unit of Product H9 as follows:

Activity Costs per Unit:

Machining: 0.5 machine hours x $17/machine hour = $8.50

Material handling: 8 material moves x $15/material move = $120

Setup: 2 setups x $500/setup = $1,000

Other overhead: 12 direct labor hours x $17.50/direct labor hour = $210

Total activity costs per unit = $1,338.50

Therefore, the overhead applied to each unit of Product H9 under activity-based costing is $1,338.50 - $260 (direct materials and direct labor) = $1,078.50 per unit. Closest option is B which is $1,078.98.

Explanation :

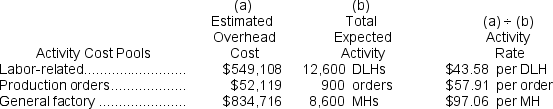

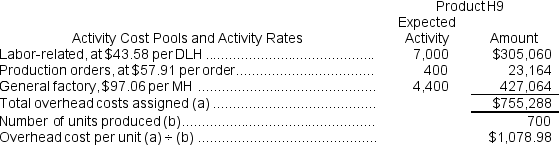

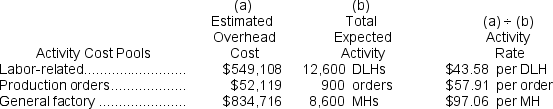

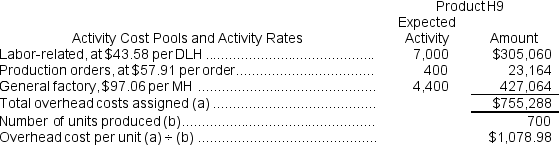

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Reference: CH04-Ref7

Reference: CH04-Ref7

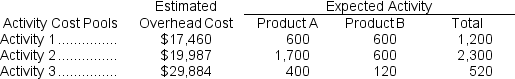

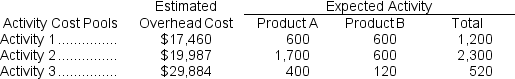

Abbe Company uses activity-based costing.The company has two products: A and B.The annual production and sales of Product A is 800 units and of Product B is 600 units.There are three activity cost pools, with estimated costs and expected activity as follows:

Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Reference: CH04-Ref7

Reference: CH04-Ref7Abbe Company uses activity-based costing.The company has two products: A and B.The annual production and sales of Product A is 800 units and of Product B is 600 units.There are three activity cost pools, with estimated costs and expected activity as follows:

Learning Objectives

- Analyze the distribution of overhead costs to particular products by applying activity-based costing methodologies.

Related questions

The Overhead Applied to Each Unit of Product K0 Under ...

The Overhead Applied to Each Unit of Product W2 Under ...

The Total Overhead Applied to Product A7 Under Activity-Based Costing ...

The Total Overhead Applied to Product E1 Under Activity-Based Costing ...

The Total Overhead Applied to Product T8 Under Activity-Based Costing ...