Asked by Jazmin Simone on May 23, 2024

Verified

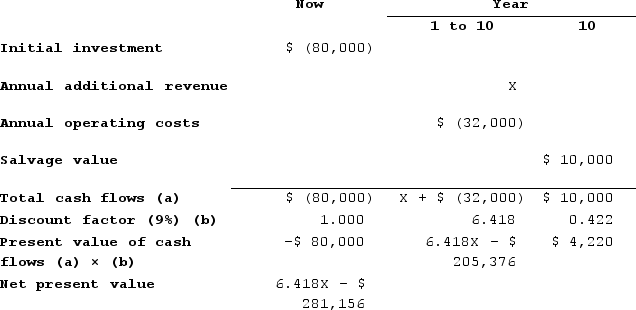

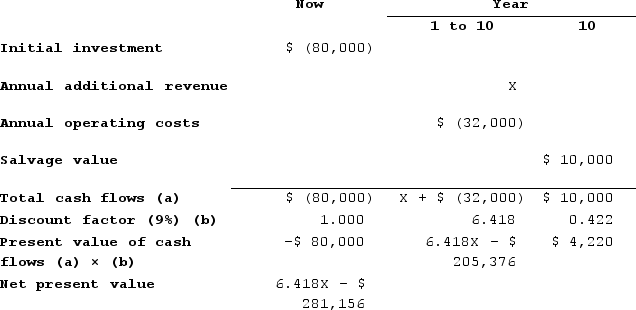

The management of an amusement park is considering purchasing a new ride for $80,000 that would have a useful life of 10 years and a salvage value of $10,000. The ride would require annual operating costs of $32,000 throughout its useful life. The company's discount rate is 9%. Management is unsure about how much additional ticket revenue the new ride would generate-particularly since customers pay a flat fee when they enter the park that entitles them to unlimited rides. Hopefully, the presence of the ride would attract new customers. (Ignore income taxes.)Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Required:How much additional revenue would the ride have to generate per year to make it an attractive investment?

Discount Rate

The interest rate fundamental to converting future cash flows into their present financial equivalent in discounted cash flow analysis.

Annual Operating Costs

The total expenses associated with running a business, facility, or equipment for one year, including utilities, salaries, and maintenance.

Additional Revenue

Income generated from activities not related to the primary operation of the business.

- Calculate supplementary cash inflows or residual values needed to render an investment profitable.

Verified Answer

JD

Jaideep DhillonMay 28, 2024

Final Answer :  6.418X − $281,156 > 06.418X > $281,156X > $281,156 ÷ 6.418 = $43,807 (rounded)

6.418X − $281,156 > 06.418X > $281,156X > $281,156 ÷ 6.418 = $43,807 (rounded)

6.418X − $281,156 > 06.418X > $281,156X > $281,156 ÷ 6.418 = $43,807 (rounded)

6.418X − $281,156 > 06.418X > $281,156X > $281,156 ÷ 6.418 = $43,807 (rounded)

Learning Objectives

- Calculate supplementary cash inflows or residual values needed to render an investment profitable.