Asked by Austin Bogle on May 25, 2024

Verified

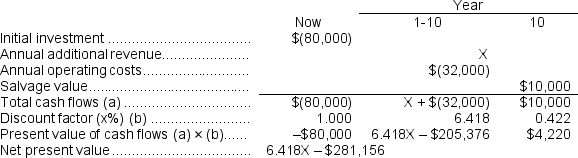

(Ignore income taxes in this problem.)The management of an amusement park is considering purchasing a new ride for $80,000 that would have a useful life of 10 years and a salvage value of $10,000.The ride would require annual operating costs of $32,000 throughout its useful life.The company's discount rate is 9%.Management is unsure about how much additional ticket revenue the new ride would generate-particularly since customers pay a flat fee when they enter the park that entitles them to unlimited rides.Hopefully, the presence of the ride would attract new customers.

Required:

How much additional revenue would the ride have to generate per year to make it an attractive investment?

Discount Rate

The rate of interest applied to discount future cash flows back to their current value, commonly employed in evaluating investments and planning for capital expenditures.

Salvage Value

The approximated financial return of an asset at the termination of its usefulness.

Operating Costs

Expenses associated with the day-to-day functioning of a business, excluding the cost of goods sold.

- Estimate additional revenue or cost savings required to make an investment project financially attractive.

Verified Answer

6.418X - $281,156 > 0

6.418X - $281,156 > 06.418X > $281,156

X > $281,156 ÷ 6.418 = $43,807 (rounded)

Learning Objectives

- Estimate additional revenue or cost savings required to make an investment project financially attractive.

Related questions

The Management of an Amusement Park Is Considering Purchasing a ...

HI Corporation Is Considering the Purchase of a Machine That ...

A Drill Press Costs $30,000 and Is Expected to Have ...

Baker Company Is Considering an Investment in a New Metal ...

Shunt Technology Will Spend $800,000 on a Piece of Equipment ...