Asked by Kymberly Corley on Jul 17, 2024

Verified

The information below relates to the Cash account in the ledger of Jason Company.

Balance September 1-$25700; Cash deposited-$96000.

Balance September 30-$22200; Checks written-$99500.

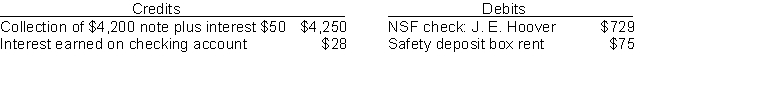

The September bank statement shows a balance of $24635 on September 30 and the following memoranda.  At September 30 deposits in transit were $4596 and outstanding checks totaled $3557.

At September 30 deposits in transit were $4596 and outstanding checks totaled $3557.

Instructions

Prepare the bank reconciliation at September 30.

Bank Reconciliation

The process of matching and comparing figures from the accounting records against those presented on a bank statement to ensure consistency and accuracy of financial data.

Memoranda

Brief, informal written records used to aid memory or inform others within an organization.

Deposits In Transit

Funds that have been sent to a bank but have not yet been recorded in the bank's records, leading to a discrepancy between the company’s cash records and bank statement.

- Understand and execute the process of bank reconciliation.

- Prepare adjusting journal entries as a result of the bank reconciliation process.

Verified Answer

Learning Objectives

- Understand and execute the process of bank reconciliation.

- Prepare adjusting journal entries as a result of the bank reconciliation process.

Related questions

The Following Adjusting Entries for Donkey Company Were Prepared After ...

The Following Information Was Used to Prepare the March 2016 ...

Bell Food Store Developed the Following Information in Recording Its \(31 ...

The Cash Balance Per Books for Potter Company on September ...

The Cash Records of Jasmin Company Show the Following Four ...