Asked by ashish adhikari on May 18, 2024

Verified

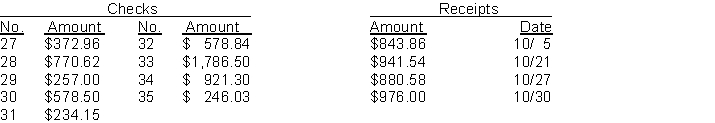

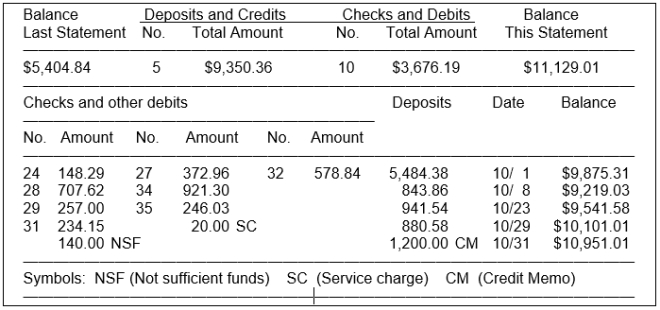

The cash balance per books for Potter Company on September 30 2015 is $10740.93. The following checks and receipts were recorded for the month of October 2015:  In addition the bank statement for the month of October is presented below:

In addition the bank statement for the month of October is presented below:  Check No. 28 was correctly written for $707.62 for a payment on account. The NSF check was from M. Short a customer in settlement of an accounts receivable. An entry had not been made for the NSF check. The credit memo is for the collection of a note receivable including interest of $80 which has not been accrued. The bank service charge is $25.00.

Check No. 28 was correctly written for $707.62 for a payment on account. The NSF check was from M. Short a customer in settlement of an accounts receivable. An entry had not been made for the NSF check. The credit memo is for the collection of a note receivable including interest of $80 which has not been accrued. The bank service charge is $25.00.

Instructions

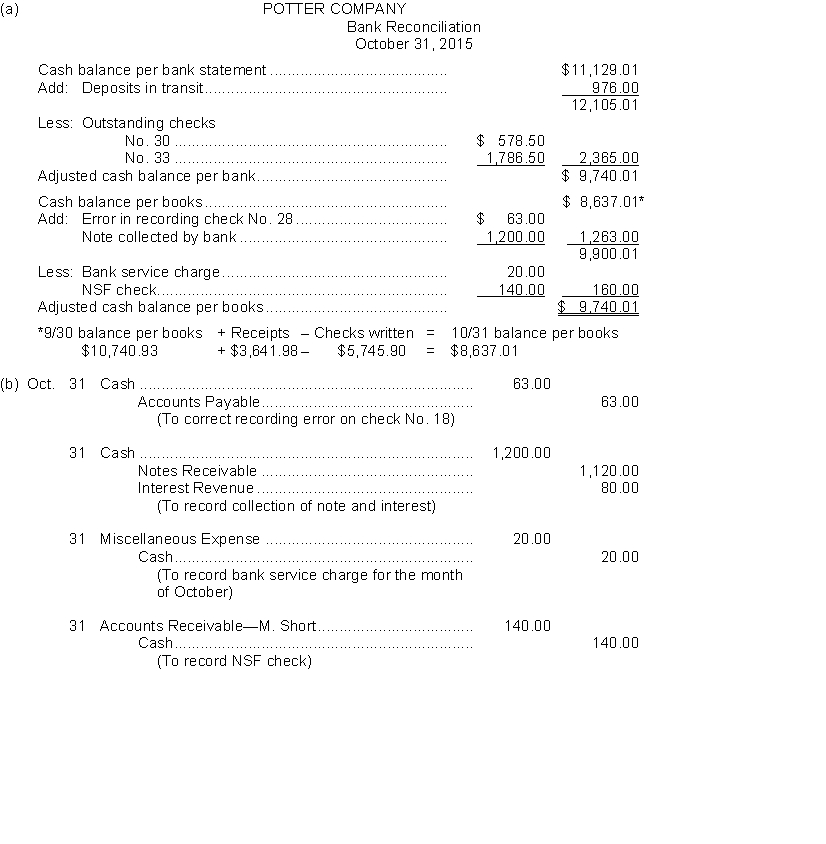

(a) Prepare a bank reconciliation at October 31.

(b) Prepare the adjusting journal entries required by the bank reconciliation.

NSF Check

A check that cannot be processed because the writer has insufficient funds.

Credit Memo

A credit memo is a document sent by a seller to a buyer, reducing the amount that the buyer owes under the terms of an earlier invoice.

Bank Service Charge

Fees charged by banks for the use of their services, such as account maintenance fees, non-sufficient funds (NSF) fees, and transaction fees.

- Familiarize with and undertake the process of aligning bank accounts.

- Create journal adjustments subsequent to the bank statement reconciliation activity.

Verified Answer

Learning Objectives

- Familiarize with and undertake the process of aligning bank accounts.

- Create journal adjustments subsequent to the bank statement reconciliation activity.

Related questions

The Following Information Was Used to Prepare the March 2016 ...

The Information Below Relates to the Cash Account in the ...

Bell Food Store Developed the Following Information in Recording Its \(31 ...

The Cash Records of Jasmin Company Show the Following Four ...

The Following Adjusting Entries for Donkey Company Were Prepared After ...