Asked by Nadiya Prashaud on May 19, 2024

Verified

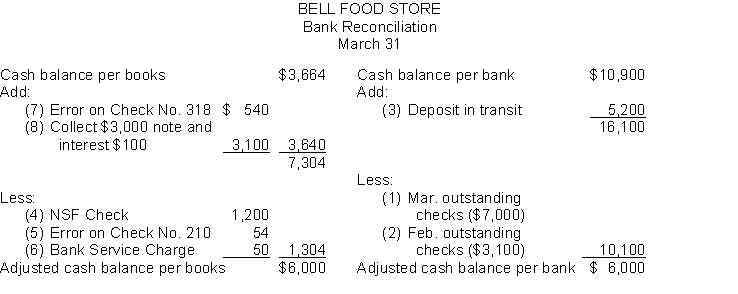

Bell Food Store developed the following information in recording its bank statement for the month of March. Balance per books March 31$3,66431 \quad \quad \quad \quad \$ 3,66431$3,664

Balance per bank statement March 31$10,90031 \quad \$ 10,90031$10,900 -------------------------------------------

(1) Checks written in March but still outstanding $7000.

(2) Checks written in February but still outstanding $3100.

(3) Deposits of March 30 and 31 not yet recorded by bank $5200.

(4) NSF check of customer returned by bank $1200.

(5) Check No. 210 for $593 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $539.

(6) Bank service charge for March was $50.

(7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in March.

(8) The bank collected a note receivable for the company for $3000 plus $100 interest revenue.

Instructions

Prepare a bank reconciliation at March 31.

NSF Check

A check that cannot be processed due to insufficient funds in the account of the drawer, commonly known as a bounced check.

Bank Service Charge

Fees charged by a bank for the maintenance of account services and other banking transactions.

Bank Reconciliation

The process of matching and comparing figures from the accounting records against those shown on a bank statement to ensure consistency.

- Absorb and execute the task of bank record reconciliation.

- Generate entries for adjustment in accounting journals derived from the process of bank reconciliation.

Verified Answer

Learning Objectives

- Absorb and execute the task of bank record reconciliation.

- Generate entries for adjustment in accounting journals derived from the process of bank reconciliation.

Related questions

The Following Information Was Used to Prepare the March 2016 ...

The Information Below Relates to the Cash Account in the ...

The Cash Balance Per Books for Potter Company on September ...

The Cash Records of Jasmin Company Show the Following Four ...

The Following Adjusting Entries for Donkey Company Were Prepared After ...