Asked by Marcos Urbina on May 04, 2024

Verified

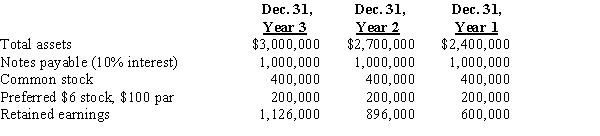

The following selected data were taken from the financial statements of the Winter Group for the three most recent years of operations:  The Year 3 net income was $242,000, and the Year 2 net income was $308,000. No dividends on common stock were declared during the three years.

The Year 3 net income was $242,000, and the Year 2 net income was $308,000. No dividends on common stock were declared during the three years.

(a)Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for Years 2 and 3. Round to one decimal place.

(b)What conclusion can be drawn from these data as to the company's profitability?

Return On

Generally a part of financial metrics like Return on Investment (ROI) or Return on Equity (ROE), indicating the efficiency of an investment or equity.

Stockholders' Equity

Represents the owners' residual interest in the assets of a corporation after deducting liabilities.

Common Stockholders' Equity

The portion of a company's equity ownership attributed to common stock, including retained earnings and contributed capital.

- Understand how to calculate return on total assets (ROA), return on stockholders' equity (ROE), and return on common stockholders' equity (ROCE).

- Interpret and conclude on a company's profitability based on financial ratios and data analysis.

Verified Answer

ZK

Zybrea KnightMay 07, 2024

Final Answer :

(a)Return on Total Assets =

(Net Income + Interest Expense )/Average Total AssetsYear 3:

($242,000 + $100,000)/$2,850,000* = 12.0%Year 2:

($308,000 + $100,000)/$2,550,000** = 16.0%*

($3,000,000 + $2,700,000)/2**

($2,700,000 + $2,400,000)/2Return on Stockholders' Equity = Net Income/Average Stockholders' EquityYear 3: $242,000/$1,611,000* = 15.0%Year 2: $308,000/$1,348,000** = 22.8%*

($1,726,000 + $1,496,000)/2**

($1,496,000 + $1,200,000)/2Return on Common Stockholders' Equity =

(Net Income - Preferred Dividends)/Average Common Stockholders' EquityYear 3:

($242,000 - $12,000)/$1,411,000* = 16.3%Year 2:

($308,000 - $12,000)/$1,148,000** = 25.8%*

($1,526,000 + $1,296,000)/2**

($1,296,000 + $1,000,000)/2

(b)The profitability ratios indicate that the Winter Group's profitability has deteriorated. Most of this change is from net income falling from $308,000 in Year 2 to $242,000 in Year 3. The cost of debt is 10%. Since the return on total assets exceeds this amount in either year, there is positive leverage from use of debt. However, this leverage is greater in Year 2 because the return on total assets exceeds the cost of debt by a greater amount in Year 2.

(Net Income + Interest Expense )/Average Total AssetsYear 3:

($242,000 + $100,000)/$2,850,000* = 12.0%Year 2:

($308,000 + $100,000)/$2,550,000** = 16.0%*

($3,000,000 + $2,700,000)/2**

($2,700,000 + $2,400,000)/2Return on Stockholders' Equity = Net Income/Average Stockholders' EquityYear 3: $242,000/$1,611,000* = 15.0%Year 2: $308,000/$1,348,000** = 22.8%*

($1,726,000 + $1,496,000)/2**

($1,496,000 + $1,200,000)/2Return on Common Stockholders' Equity =

(Net Income - Preferred Dividends)/Average Common Stockholders' EquityYear 3:

($242,000 - $12,000)/$1,411,000* = 16.3%Year 2:

($308,000 - $12,000)/$1,148,000** = 25.8%*

($1,526,000 + $1,296,000)/2**

($1,296,000 + $1,000,000)/2

(b)The profitability ratios indicate that the Winter Group's profitability has deteriorated. Most of this change is from net income falling from $308,000 in Year 2 to $242,000 in Year 3. The cost of debt is 10%. Since the return on total assets exceeds this amount in either year, there is positive leverage from use of debt. However, this leverage is greater in Year 2 because the return on total assets exceeds the cost of debt by a greater amount in Year 2.

Learning Objectives

- Understand how to calculate return on total assets (ROA), return on stockholders' equity (ROE), and return on common stockholders' equity (ROCE).

- Interpret and conclude on a company's profitability based on financial ratios and data analysis.