Asked by Matias Morales on Jun 13, 2024

Verified

Selected data from Carmen Company at year-end are presented below. Total assets $2,000,000 Average total assets $2,200,000 Net income $250,000 Sales $1,300,000 Average common stockholders’ equity $1,000,000 Net cash provided by operating activities $275,000 Shares of common stock outstanding 10,000 Long-term investments $400,000\begin{array}{lr}\text { Total assets } & \$ 2,000,000 \\\text { Average total assets } & \$ 2,200,000 \\\text { Net income } & \$ 250,000 \\\text { Sales } & \$ 1,300,000 \\\text { Average common stockholders' equity } & \$ 1,000,000 \\\text { Net cash provided by operating activities } & \$ 275,000 \\\text { Shares of common stock outstanding } & 10,000 \\\text { Long-term investments } & \$ 400,000\end{array} Total assets Average total assets Net income Sales Average common stockholders’ equity Net cash provided by operating activities Shares of common stock outstanding Long-term investments $2,000,000$2,200,000$250,000$1,300,000$1,000,000$275,00010,000$400,000 Calculate:

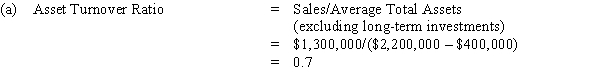

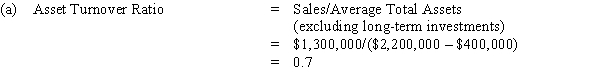

(a) Asset turnover ratio

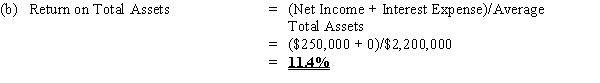

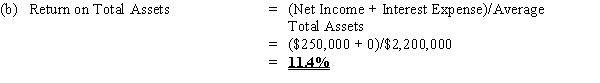

(b) Return on total assets

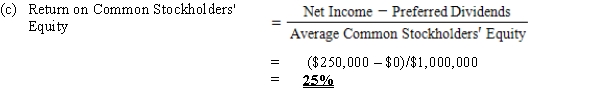

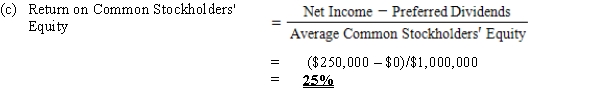

(c) Return on common stockholders' equity

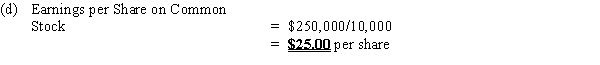

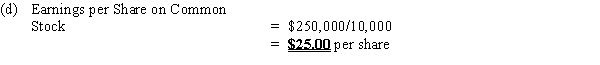

(d) Earnings per share on common stock.Assume the company had no preferred stock or interest expense.Round dollar values to two decimal places and other final answers to one decimal place.

Asset Turnover Ratio

A financial metric that measures the efficiency of a company's use of its assets in generating sales revenue.

Return On

A financial ratio that measures the amount of return generated relative to the investment made.

Earnings Per Share

A measure of a company's profitability, calculated as the net income divided by the number of outstanding shares of its common stock.

- Master the techniques involved in evaluating return on total assets (ROA), return on stockholders' equity (ROE), and return on common stockholders' equity (ROCE).

- Calculate and understand the significance of asset turnover ratio.

- Understand and calculate earnings per share (EPS) and how it affects shareholder value.

Verified Answer

AH

Alexa HaightJun 15, 2024

Final Answer :

With the information provided, the profitability ratios that can be calculated are as follows:

Learning Objectives

- Master the techniques involved in evaluating return on total assets (ROA), return on stockholders' equity (ROE), and return on common stockholders' equity (ROCE).

- Calculate and understand the significance of asset turnover ratio.

- Understand and calculate earnings per share (EPS) and how it affects shareholder value.