Asked by Sabrina Mitchell on Jul 12, 2024

Verified

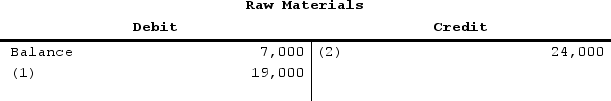

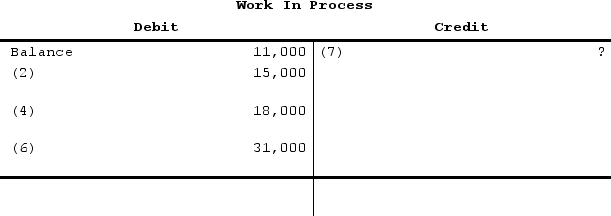

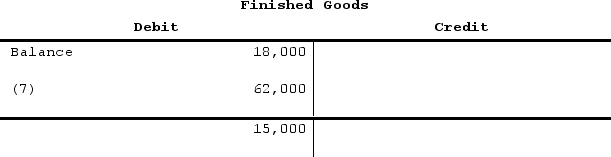

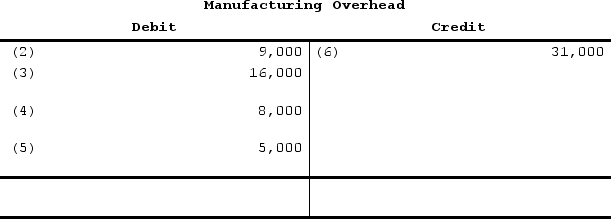

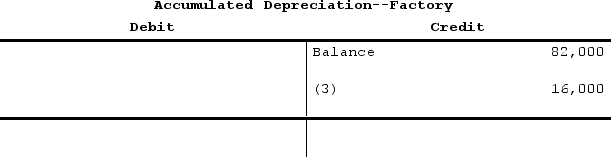

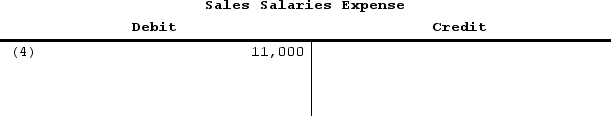

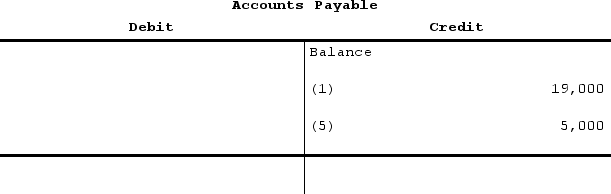

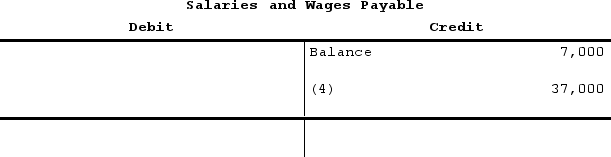

The following partially completed T-accounts are for Stanford Corporation:

The cost of direct materials used is:

The cost of direct materials used is:

A) $14,000

B) $15,000

C) $18,000

D) $24,000

Direct Materials

Materials directly linked to the creation of certain products or services.

T-Accounts

A visual representation of accounts used in double-entry bookkeeping, showing debits on the left side and credits on the right.

Cost Of Goods Sold

The expenses directly related to the manufacture of products a company sells, which include the costs of materials and labor.

- Learn about the role T-accounts play in tracking and consolidating transactions related to manufacturing expenses, which include direct materials, direct labor, and manufacturing overhead.

Verified Answer

LM

Leigh MemunatuJul 12, 2024

Final Answer :

B

Explanation :

The direct materials are debited to the Raw Materials Inventory account and credited to Accounts Payable. The increase in raw materials inventory from $12,000 to $16,000 indicates an increase in the cost of direct materials purchased, which can be calculated by subtracting the beginning balance from the ending balance:

$16,000 - $12,000 = $4,000 increase in raw materials inventory

Since raw materials purchased equals the increase in raw materials inventory plus the cost of direct materials used, we can solve for the cost of direct materials used:

Raw materials purchased = $4,000 + Direct materials used

$18,000 = $4,000 + Direct materials used

Direct materials used = $14,000

$16,000 - $12,000 = $4,000 increase in raw materials inventory

Since raw materials purchased equals the increase in raw materials inventory plus the cost of direct materials used, we can solve for the cost of direct materials used:

Raw materials purchased = $4,000 + Direct materials used

$18,000 = $4,000 + Direct materials used

Direct materials used = $14,000

Learning Objectives

- Learn about the role T-accounts play in tracking and consolidating transactions related to manufacturing expenses, which include direct materials, direct labor, and manufacturing overhead.