Asked by Viraj Mistry on Jul 14, 2024

Verified

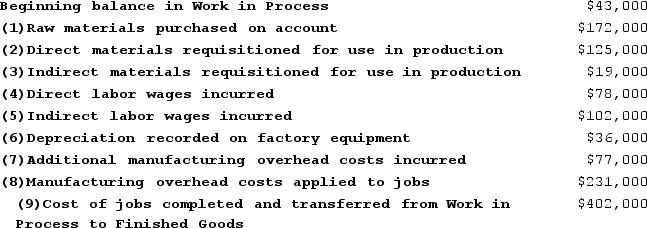

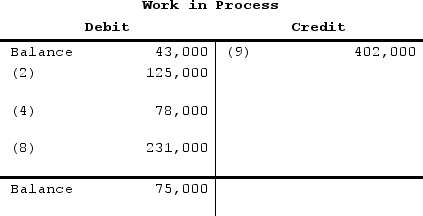

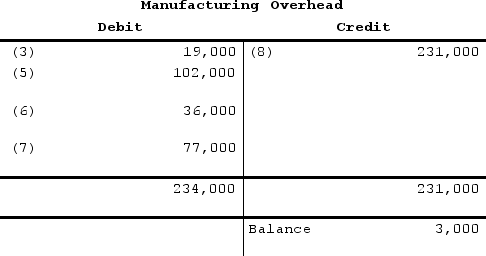

Easterling Corporation uses a job-order costing system. The following data relate to the just completed month's operations.

Required:

Required:

a. Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts.

b. Determine the underapplied or overapplied overhead for the month.

Job-Order Costing

A costing methodology used to allocate costs to individual products or job orders, allowing for detailed tracking of expenses.

Overapplied Overhead

A situation where the overhead allocated to products exceeds the actual overhead costs incurred, indicating that too much overhead cost was allocated to production.

Underapplied Overhead

The situation where the allocated overhead costs are less than the actual overhead costs incurred.

- Formulate T-accounts tailored to the segments of manufacturing expenses and register the involved transactions.

- Assess the consequences of overapplied or underapplied overhead on financial statements.

Verified Answer

</div> <div style=" display: inline-block;">

</div> <div style=" display: inline-block;"> b. The overhead is $3,000 underapplied because the actual manufacturing overhead cost incurred of $234,000 exceeds the manufacturing overhead applied of $231,000 by $3,000

b. The overhead is $3,000 underapplied because the actual manufacturing overhead cost incurred of $234,000 exceeds the manufacturing overhead applied of $231,000 by $3,000

Learning Objectives

- Formulate T-accounts tailored to the segments of manufacturing expenses and register the involved transactions.

- Assess the consequences of overapplied or underapplied overhead on financial statements.

Related questions

Alberta Corporation Uses a Job-Order Costing System ...

Overapplied Overhead Is the Amount by Which Actual Overhead Cost ...

Mike Hilyer Is Confused About Under and Overapplied Manufacturing Overhead ...

Landis Company Uses a Job Order Cost System in Each ...

If Actual Manufacturing Overhead Was Greater Than the Amount of ...