Asked by Gavin Pabst on May 03, 2024

Verified

Alberta Corporation uses a job-order costing system. The following data relate to the just completed month's operations.

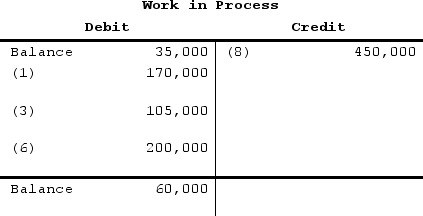

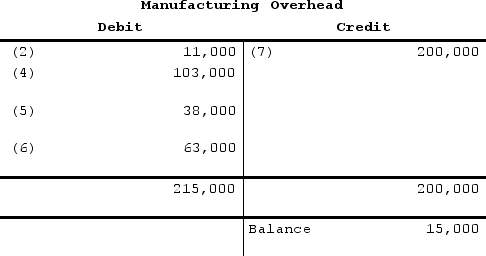

(1) Direct materials requisitioned for use in production, $170,000(2) Indirect materials requisitioned for use in production, $11,000(3) Direct labor wages incurred, $105,000(4) Indirect labor wages incurred, $103,000(5) Depreciation recorded on factory equipment, $38,000(6) Additional manufacturing overhead costs incurred, $63,000(7) Manufacturing overhead costs applied to jobs, $200,000(8) Cost of jobs completed and transferred from Work in Process to Finished Goods, $450,000Required:

a. Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts.

b. Determine the underapplied or overapplied overhead for the month.

Direct Materials

The cost of raw materials and components used directly in the production of goods.

Indirect Materials

Materials used in the production process that cannot be directly traced to the final product, such as lubricants and cleaning supplies, and are classified as overhead costs.

Manufacturing Overhead

Includes all manufacturing costs except direct materials and direct labor, covering expenses like utilities, depreciation, and equipment maintenance in a production facility.

- Construct T-accounts applicable to manufacturing cost types and log the corresponding transactions.

- Analyze the effects of not accurately applying overhead costs to financial reports.

Verified Answer

</div> <div style=" display: inline-block;">

</div> <div style=" display: inline-block;"> b. The overhead is $15,000 underapplied because the actual manufacturing overhead cost incurred of $215,000 exceeds the manufacturing overhead applied of $200,000 by $15,000

b. The overhead is $15,000 underapplied because the actual manufacturing overhead cost incurred of $215,000 exceeds the manufacturing overhead applied of $200,000 by $15,000

Learning Objectives

- Construct T-accounts applicable to manufacturing cost types and log the corresponding transactions.

- Analyze the effects of not accurately applying overhead costs to financial reports.

Related questions

Easterling Corporation Uses a Job-Order Costing System ...

Overapplied Overhead Is the Amount by Which Actual Overhead Cost ...

Landis Company Uses a Job Order Cost System in Each ...

If Actual Manufacturing Overhead Was Greater Than the Amount of ...

Mike Hilyer Is Confused About Under and Overapplied Manufacturing Overhead ...