Asked by Devon Westerlund on Jun 04, 2024

Verified

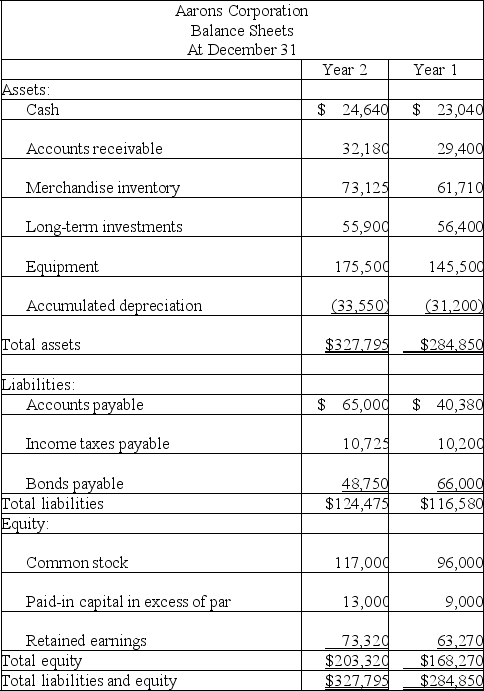

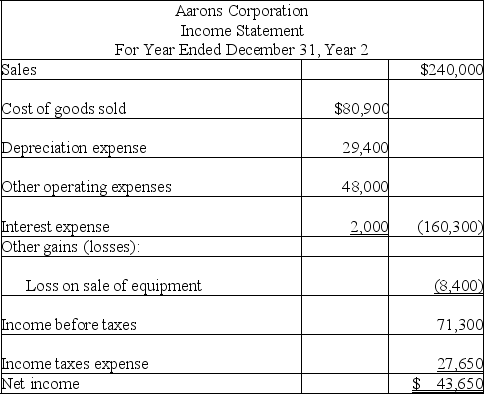

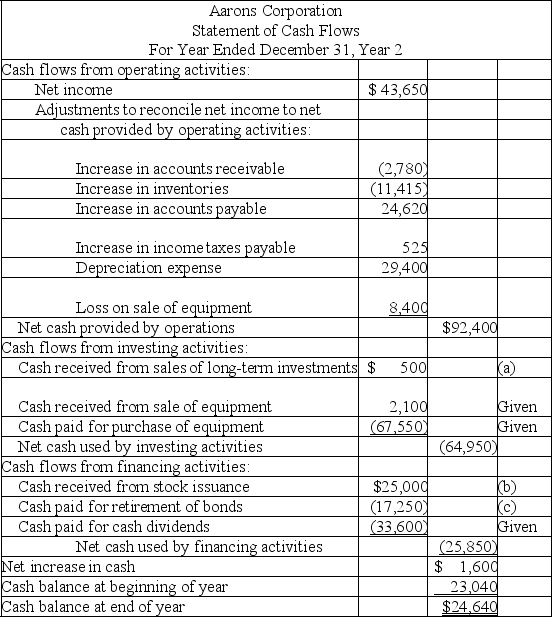

The following information is available for the Aarons Corporation:

Additional information:

Additional information:

(1)There was no gain or loss on the sales of the long-term investments,nor on the bonds retired.

(2)Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3)New equipment was purchased for $67,550 cash.

(4)Cash dividends of $33,600 were paid.

(5)Additional shares of stock were issued for cash.

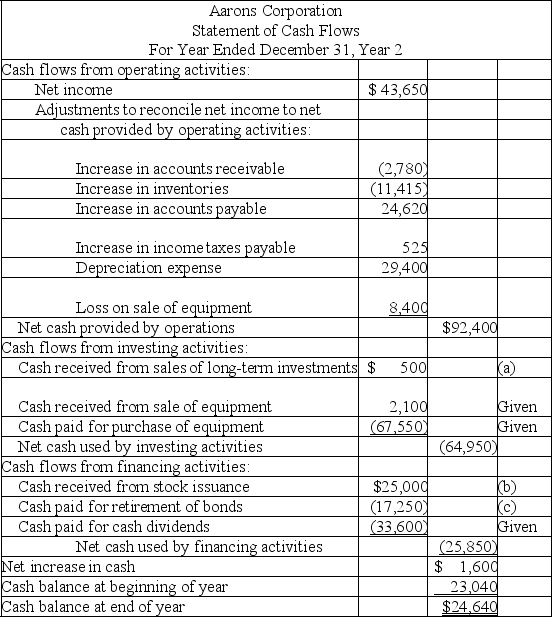

Prepare a complete statement of cash flows for Year 2 using the indirect method.

Indirect Method

An approach to preparing the cash flow statement where the net income is adjusted for non-cash transactions and changes in working capital to estimate cash flows from operating activities.

Cash Dividends

A distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders in the form of cash.

Long-Term Investments

Assets that a company intends to hold for more than one year, including stocks, bonds, and real estate.

- Formulate the Cash Flow Statement by employing the indirect strategy.

Verified Answer

ES

Ernestina SorianoJun 08, 2024

Final Answer :  (a)Received from sales of long-term investments: $56,400 - $55,900 = $500

(a)Received from sales of long-term investments: $56,400 - $55,900 = $500

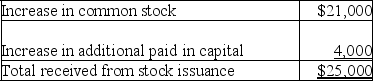

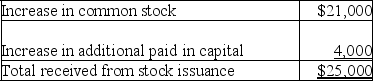

(b)Received from stock issuance:

(c)Paid to retire bonds: $66,000 - $48,750 = $17,250

(c)Paid to retire bonds: $66,000 - $48,750 = $17,250

(a)Received from sales of long-term investments: $56,400 - $55,900 = $500

(a)Received from sales of long-term investments: $56,400 - $55,900 = $500(b)Received from stock issuance:

(c)Paid to retire bonds: $66,000 - $48,750 = $17,250

(c)Paid to retire bonds: $66,000 - $48,750 = $17,250

Learning Objectives

- Formulate the Cash Flow Statement by employing the indirect strategy.