Asked by Taylor Johnson on Jun 18, 2024

Verified

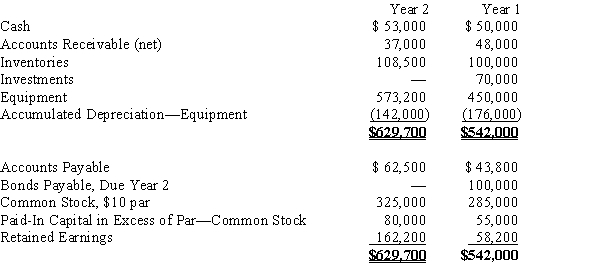

The comparative balance sheets of Posner Company, for Years 1 and 2 ended December 31, appear below in condensed form.  The income statement for the current year is as follows:

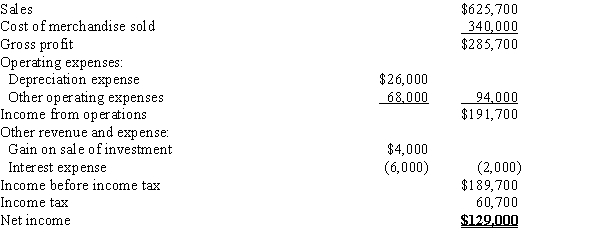

The income statement for the current year is as follows:  Additional data for the current year are as follows:

Additional data for the current year are as follows:

(a)Fully depreciated equipment costing $60,000 was scrapped, no salvage, and new equipment was purchased for $183,200.

(b)Bonds payable for $100,000 were retired by payment at their face amount.

(c)5,000 shares of common stock were issued at $13 for cash.

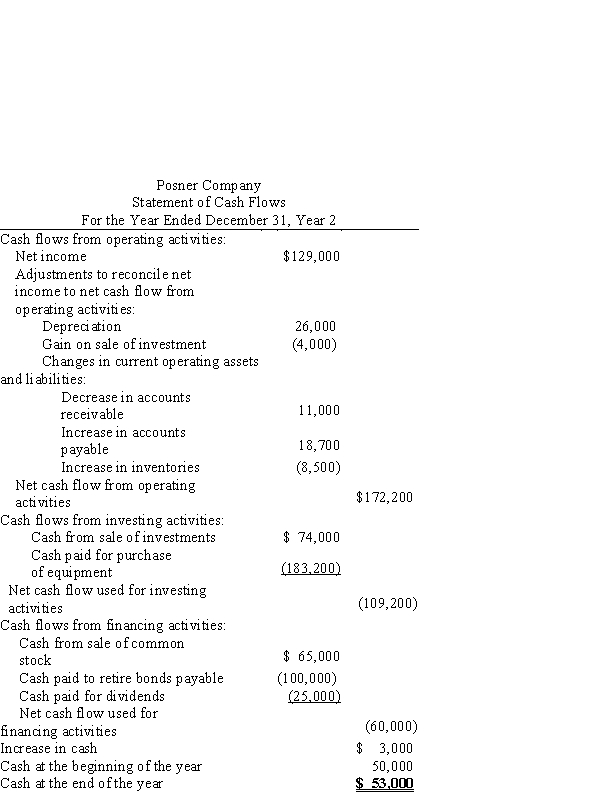

(d)Cash dividends declared and paid, $25,000.Prepare a statement of cash flows using the indirect method of reporting cash flows from operating activities.

Statement of Cash Flows

A financial report that depicts how variations in income and balance sheet accounts affect the cash and cash equivalents, organized into the segments of operating activities, investing activities, and financing activities.

Operating Activities

Activities that relate to the primary operations of a company, such as sales, provision of services, and production.

Indirect Method

This approach is used in cash flow statements to report net income and adjust it for changes in assets and liabilities that affect cash but are not cash transactions themselves.

- Assemble the cash flow statement applying the indirect method.

- Revamp net earnings by incorporating shifts in operating assets and liabilities, to compute the cash flows derived from operations.

- Discern the impact that property, plant, and equipment transactions exert on the statement of cash flows.

Verified Answer

YO

Learning Objectives

- Assemble the cash flow statement applying the indirect method.

- Revamp net earnings by incorporating shifts in operating assets and liabilities, to compute the cash flows derived from operations.

- Discern the impact that property, plant, and equipment transactions exert on the statement of cash flows.