Asked by Mckenna Grimm on May 13, 2024

Verified

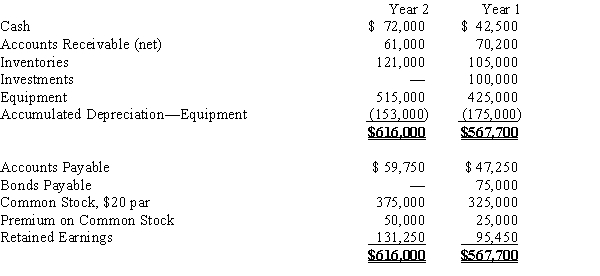

The comparative balance sheets of Barry Company, for Years 1 and 2 ended December 31, appear below in condensed form.  Additional data for the current year are as follows:

Additional data for the current year are as follows:

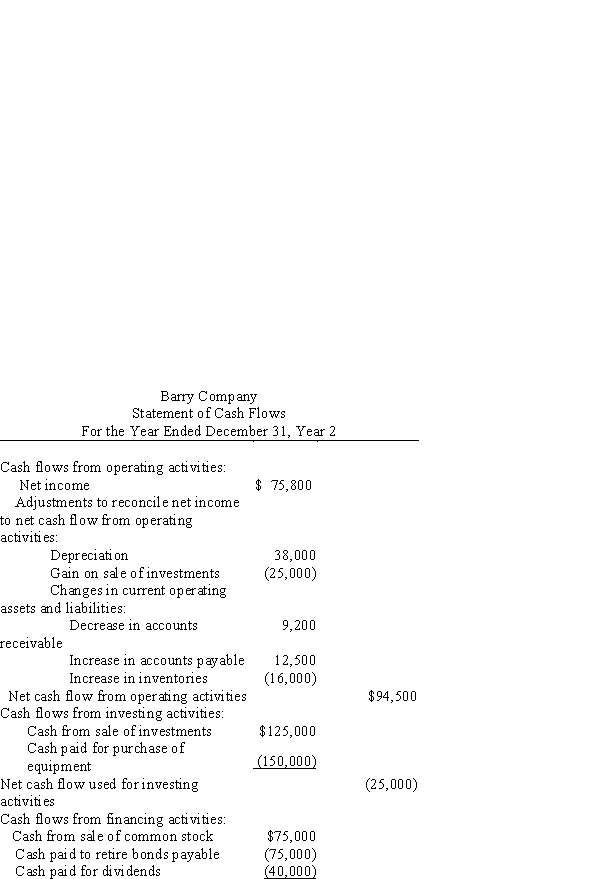

(a)Net income, $75,800.

(b)Depreciation reported on income statement, $38,000.

(c)Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d)Bonds payable for $75,000 were retired by payment at their face amount.

(e)2,500 shares of common stock were issued at $30 for cash.

(f)Cash dividends declared and paid, $40,000.

(g)Investments of $100,000 were sold for $125,000.Prepare a statement of cash flows using the indirect method.

Statement of Cash Flows

A financial statement that provides an aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources, as well as all cash outflows that pay for business activities and investments during a given period.

Operating Activities

Transactions and events that impact the net income of a business, primarily related to its core operations.

Indirect Method

A way of reporting cash flows from operating activities in the cash flow statement, starting with net income and adjusting for non-cash transactions.

- Reconfigure net income in light of alterations in operational assets and liabilities to generate an analysis of cash flows from operational activities.

- Perceive the implications of property, plant, and equipment transactions on the statement of cash flows.

- Formulate the statement of cash flows via the indirect method.

Verified Answer

Learning Objectives

- Reconfigure net income in light of alterations in operational assets and liabilities to generate an analysis of cash flows from operational activities.

- Perceive the implications of property, plant, and equipment transactions on the statement of cash flows.

- Formulate the statement of cash flows via the indirect method.

Related questions

The Following Information Is Available for the Aarons Corporation ...

On the Basis of the Following Data for Breach Co ...

Samuel Company's Accumulated Depreciation-Equipment Account Increased by $6,000, While Patents ...

On the Basis of the Following Data for Branch Co ...

Based on the Information Provided Below for Krackle Corp ...