Asked by Samantha Stoner on Jul 11, 2024

Verified

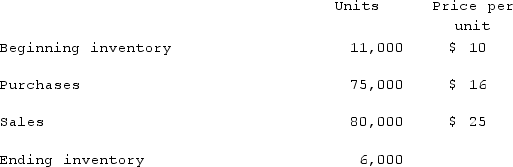

The following information for Urbanski Corporation relates to the three months ending June 30, 2021:  Urbanski uses the LIFO method to account for inventory, and expects at least 15,000 units to be on hand in the ending inventory at year-end. Purchases made in the last six months are expected to cost an average of $18 per unit.Prepare the journal entries to reflect the sales and cost of goods sold, assuming Urbanski expects to maintain 11,000 units in inventory at year-end.

Urbanski uses the LIFO method to account for inventory, and expects at least 15,000 units to be on hand in the ending inventory at year-end. Purchases made in the last six months are expected to cost an average of $18 per unit.Prepare the journal entries to reflect the sales and cost of goods sold, assuming Urbanski expects to maintain 11,000 units in inventory at year-end.

LIFO Method

"Last In, First Out," an inventory accounting method where the most recently acquired items are assumed to be sold first.

Journal Entries

The individual records of financial transactions in a company's accounting system.

Cost of Goods Sold

An accounting term for the direct expenses related to producing the goods sold by a company, including materials and labor.

- Compile ledger entries for designated financial transactions.

Verified Answer

![Journal Entries to Record Sales and Cost of Goods Sold Excess of replacement cost over historical cost for beginning inventory liquidated:[($18 − $10) × 5,000 units]](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_cdc5_f939_948d_93ae0e4647c6_TB7395_00.jpg) Excess of replacement cost over historical cost for beginning inventory liquidated:[($18 − $10) × 5,000 units]

Excess of replacement cost over historical cost for beginning inventory liquidated:[($18 − $10) × 5,000 units]

Learning Objectives

- Compile ledger entries for designated financial transactions.

Related questions

The Following Information for Urbanski Corporation Relates to the Three ...

Trapper Company's Unadjusted and Adjusted Trial Balances on December 31 ...

The Following Unadjusted and Adjusted Trial Balances Are from the ...

Record the December 31 Adjusting Entries for the Following Transactions ...

For Each of the Following Two Separate Situations,present Both the ...