Asked by Amaya Jones on May 14, 2024

Verified

Record the December 31 adjusting entries for the following transactions and events in general journal form.Assume that December 31 is the end of the annual accounting period.

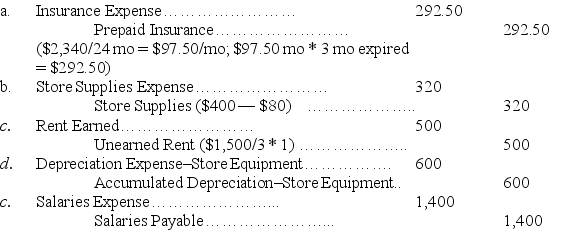

a.The Prepaid Insurance account shows a debit balance of $2,340,representing the cost of a two-year fire insurance policy that was purchased on October 1 of the current year and has not been adjusted to-date.

b.The Store Supplies account has a debit balance of $400; a year-end inventory count reveals $80 of supplies still on hand.

c.On November 1 of the current year,Rent Earned was credited for $1,500.This amount represented the rent earned for a three-month period beginning November 1.

d.Estimated depreciation on store equipment is $600.

e.Accrued salaries amount to $1,400.

Adjusting Entries

Fiscal period closing entries in accounts to properly assign incomes and expenditures to the interval in which they factually took place.

Prepaid Insurance

An asset account that represents insurance premiums paid in advance, covering future periods.

Depreciation

Depreciation is the accounting process of allocating the cost of a tangible asset over its useful life, recognizing it as an expense.

- Acquire understanding and carry out the development of journal entries for assorted accounting activities.

Verified Answer

Learning Objectives

- Acquire understanding and carry out the development of journal entries for assorted accounting activities.

Related questions

Trapper Company's Unadjusted and Adjusted Trial Balances on December 31 ...

For Each of the Following Two Separate Situations,present Both the ...

Based on the Unadjusted Trial Balance for Highlight Styling and ...

The Following Unadjusted and Adjusted Trial Balances Are from the ...

Werner Company Had $1,300 of Store Supplies at the Beginning ...