Asked by Trinity O'Neill-Torres on Jul 12, 2024

Verified

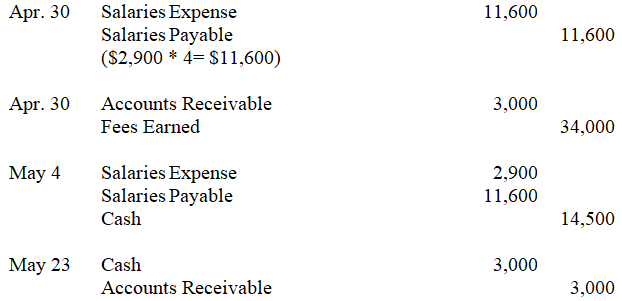

For each of the following two separate situations,present both the April 30 adjusting entry and the subsequent entry during May to record the payment of the accrued expenses or receipt of the accrued revenue.Assume the company does not prepare reversing entries.

a.Nicolas Company has 5 employees,who earn a total of $2,900 in salaries each working day.They are paid on Monday for the five-day workweek ending on the previous Friday.Assume that fiscal year ended April 30,is a Thursday and all employees worked each day and will be paid salaries for five full days on the following Monday.

b.Services of $3,000 have been performed for Clevenger Company through April 30.The client will pay the entire amount of the contract when services are completed on May 23.

c.Paid the employees' salaries on May 4.

d.Received payment from Clevenger Company for services that are now completed on May 23.

Adjusting Entry

An accounting entry made in the books at the end of an accounting period to allocate revenues and expenditures to the period in which they actually occurred.

Accrued Expenses

Expenses that have been incurred but not yet paid or recorded in the financial statements, representing future obligations.

Accrued Revenue

Revenue that has been earned but not yet received in cash or recorded by the accounting system.

- Comprehend and implement the preparation of journal entries for diverse accounting transactions.

- Gain insight into the accumulation of revenues and expenses and their effects on financial statements.

Verified Answer

Learning Objectives

- Comprehend and implement the preparation of journal entries for diverse accounting transactions.

- Gain insight into the accumulation of revenues and expenses and their effects on financial statements.

Related questions

Werner Company Had $1,300 of Store Supplies at the Beginning ...

Based on the Unadjusted Trial Balance for Highlight Styling and ...

If a Prepaid Expense Account Were Not Adjusted for the ...

The Following Unadjusted and Adjusted Trial Balances Are from the ...

Trapper Company's Unadjusted and Adjusted Trial Balances on December 31 ...