Asked by Olivia Storm on May 07, 2024

Verified

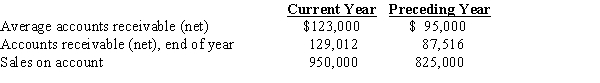

The following data are taken from the financial statements:?  (a)Assuming that credit terms on all sales are n/45, determine for each year:

(a)Assuming that credit terms on all sales are n/45, determine for each year:

(1)Accounts receivable turnover

(2)Number of days' sales in receivables (Round intermediate calculation to the nearest whole number and your final answer to two decimal places.)

(b)Comment on any significant trends revealed by the data.

Accounts Receivable Turnover

A financial ratio that measures how efficiently a company collects revenue by comparing net credit sales to the average accounts receivable.

Days' Sales

A measure of how efficiently a company converts its inventory into sales, typically calculated as days' sales in inventory or days sales outstanding.

Credit Terms

Conditions under which credit is extended by a seller to a buyer, detailing the repayment period, discount for early payment, and penalty for late payment.

- Render and clarify significant financial ratios, which encompass the current ratio, quick ratio, inventory turnover, accounts receivable turnover, and times interest earned.

- Use vertical and horizontal analytical methods to assess a corporation's financial stability.

Verified Answer

DH

Dakarai HughesMay 12, 2024

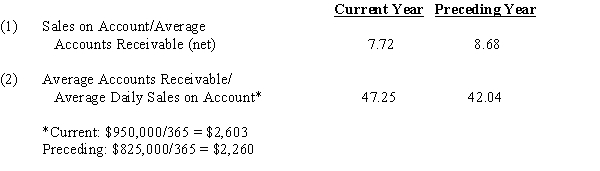

Final Answer :

(a)  (b)Although sales increased during the current year, a favorable trend, several unfavorable trends are disclosed by the analysis. The accounts receivable turnover has declined from 8.68 in the preceding year to 7.72 in the current year. Based on credit terms of n/45, a turnover of less than 8 indicates that some receivables are not being collected within the 45-day period. Likewise, the number of days' sales in receivables indicates an unfavorable trend, increasing from 42.04 at the end of the preceding year to 47.25 at the end of the current year.

(b)Although sales increased during the current year, a favorable trend, several unfavorable trends are disclosed by the analysis. The accounts receivable turnover has declined from 8.68 in the preceding year to 7.72 in the current year. Based on credit terms of n/45, a turnover of less than 8 indicates that some receivables are not being collected within the 45-day period. Likewise, the number of days' sales in receivables indicates an unfavorable trend, increasing from 42.04 at the end of the preceding year to 47.25 at the end of the current year.

(b)Although sales increased during the current year, a favorable trend, several unfavorable trends are disclosed by the analysis. The accounts receivable turnover has declined from 8.68 in the preceding year to 7.72 in the current year. Based on credit terms of n/45, a turnover of less than 8 indicates that some receivables are not being collected within the 45-day period. Likewise, the number of days' sales in receivables indicates an unfavorable trend, increasing from 42.04 at the end of the preceding year to 47.25 at the end of the current year.

(b)Although sales increased during the current year, a favorable trend, several unfavorable trends are disclosed by the analysis. The accounts receivable turnover has declined from 8.68 in the preceding year to 7.72 in the current year. Based on credit terms of n/45, a turnover of less than 8 indicates that some receivables are not being collected within the 45-day period. Likewise, the number of days' sales in receivables indicates an unfavorable trend, increasing from 42.04 at the end of the preceding year to 47.25 at the end of the current year.

Learning Objectives

- Render and clarify significant financial ratios, which encompass the current ratio, quick ratio, inventory turnover, accounts receivable turnover, and times interest earned.

- Use vertical and horizontal analytical methods to assess a corporation's financial stability.